Macro Briefing: 26 June 2025

“There could be hiccups along the way, but the market is saying this (conflict) is likely over,” Robert Yawger, commodities specialist at Mizuho Securities, told CNN Tuesday… “Markets breathed a sigh of relief following Trump’s ceasefire declaration, but the celebration could be short-liv…

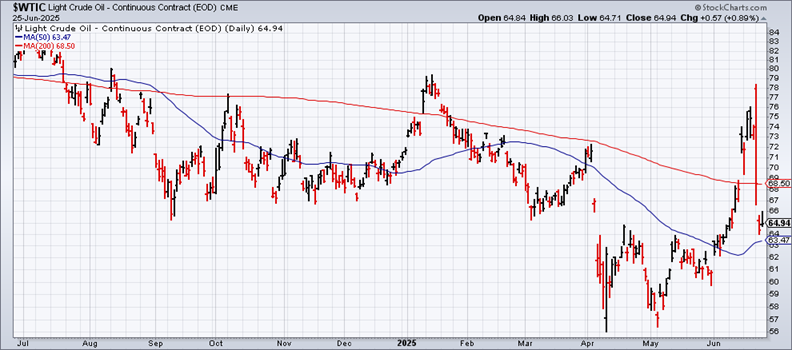

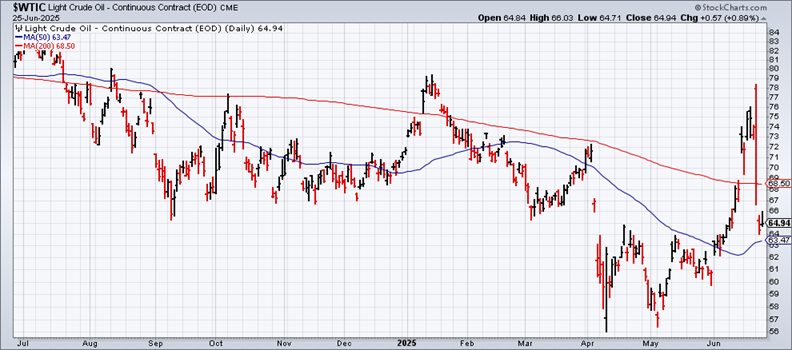

US crude oil fell on Wednesday to a level that’s below the price on June 13, when the Israel-Iran conflict started. “There could be hiccups along the way, but the market is saying this (conflict) is likely over,” Robert Yawger, commodities specialist at Mizuho Securities, told CNN Tuesday. “Markets breathed a sigh of relief following Trump’s ceasefire declaration, but the celebration could be short-lived,” said Lukman Otunuga, senior market analyst at FXTM, in a note to investors. “If tensions flare again or the ceasefire is violated, we could see a swift return to risk aversion — boosting safe havens like gold and pressuring global equities.”

President Trump is considering naming the next Federal Reserve chief early, The Wall Street Journal reports: “President Trump’s exasperation over the Federal Reserve’s take-it-slow approach to cutting interest rates is prompting him to consider accelerating when he will announce his pick to succeed Chair Jerome Powell, whose term runs for another 11 months.”

New US home sales fell sharply in May, falling 13.7% compared with April. The level is 6.3% lower than in May 2024. “The large fall in new home sales in May cancels out all of the positivity of the past couple of months and serves as a valuable reminder that buyer activity can only rise so far with mortgage rates hugging 7%,” wrote Bradley Saunders, an economist at Capital Economics.

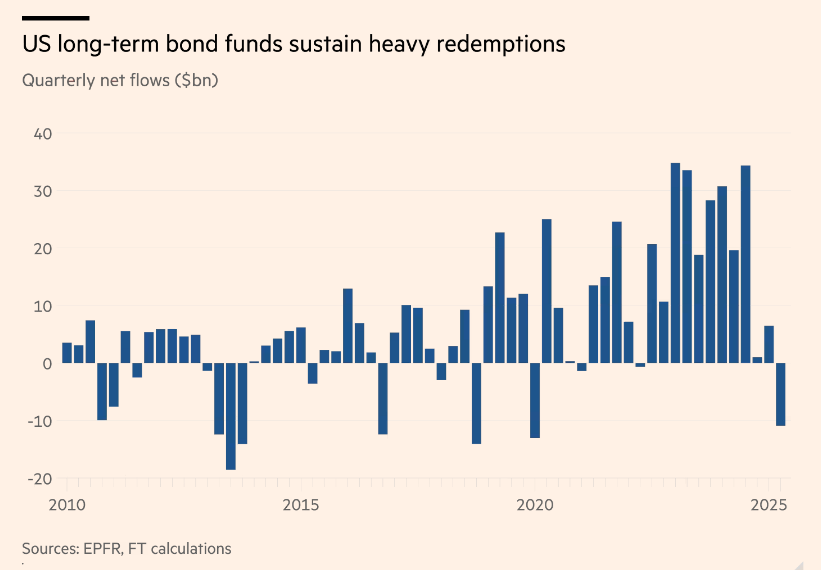

Investors are fleeing long-term US bond funds at the swiftest rate since the height of the Covid-19 pandemic five years ago, reports Financial Times. America’s surging debt load is considered a key factor. Net outflows from long-dated US bond funds holding government and corporate debt have reached nearly $11 billion in the second quarter, according to analysis by Financial Times based on EPFR data. “[The fund outflows are] a symptom of a much bigger problem. There is a lot of concern domestically and from the foreign investor community about owning the long end of the Treasury curve,” said Bill Campbell at DoubleLine, a bond manager.

Author: James Picerno