Macro Briefing: 1 July 2025

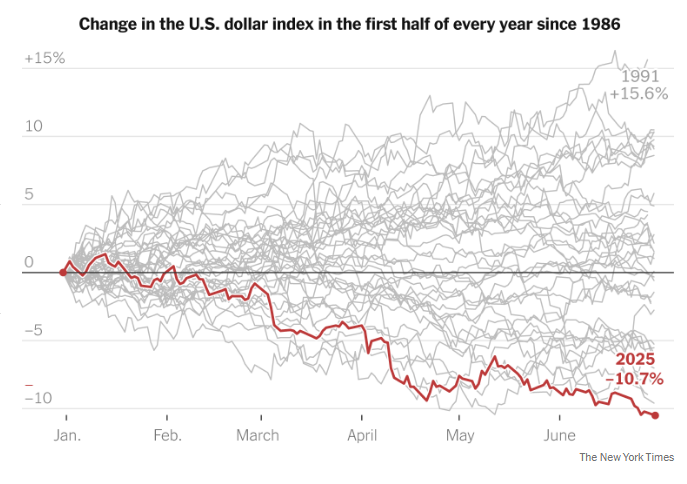

The US dollar has fallen more than 10% year to date, the weakest start for a calendar year since 1973… The dollar’s slide is making investments in the US by foreigners more expensive… “A weaker dollar has become a crowded trade and I suspect the pace of decline will slow,” said Guy Miller,…

The US dollar has fallen more than 10% year to date, the weakest start for a calendar year since 1973. The combination tariffs, inflation concerns and rising government debt are weighing on the greenback. The dollar’s slide is making investments in the US by foreigners more expensive. “A weaker dollar has become a crowded trade and I suspect the pace of decline will slow,” said Guy Miller, chief market strategist at insurance group Zurich.

The Senate continues to debate President Donald Trump’s sweeping domestic policy bill. The multitrillion-dollar bill would lower federal taxes and shift more money into the Pentagon and border security agencies, while downsizing government safety-net programs including Medicaid.

The Dallas Fed Manufacturing Index was mostly unchanged in June: “The production index, a key measure of state manufacturing conditions, held steady at 1.3, with the near-zero reading indicating a second month of flat output.”

The Chicago PMI continued falling in June, dropping to a 5-month low. This barometer of business conditions and the economic health of the manufacturing sector in the Chicago region slipped to 40.4 this month from 40.5, holding well below the neutral 50 mark.

The Treasury market in June scored its strongest its monthly performance since February. A Bloomberg index of the debt posted a monthly return of 0.9% through Friday amid bets that the Federal Reserve will cut interest rates at least twice this year.

US fiscal risk has been steady recently as the Senate prepares to vote on a massive spending bill that’s expected to raise the federal budget deficit in the years ahead, according to TMC Research, a unit of The Milwaukee Company. The US Fiscal Risk Index remains at the upper range — 0.3 — that’s prevailed over the last several years as of June 27.

Author: James Picerno