Momentum And High-Beta Equity Factors Lead Market This Year

The dominance of the momentum factor roars on… At nearly every step this year, this risk factor has outperformed the broad stock market, based on a set of ETFs through yesterday’s close (Aug… The recent rebound in so-called high-beta stocks has lifted this factor to a strong second-place perfo…

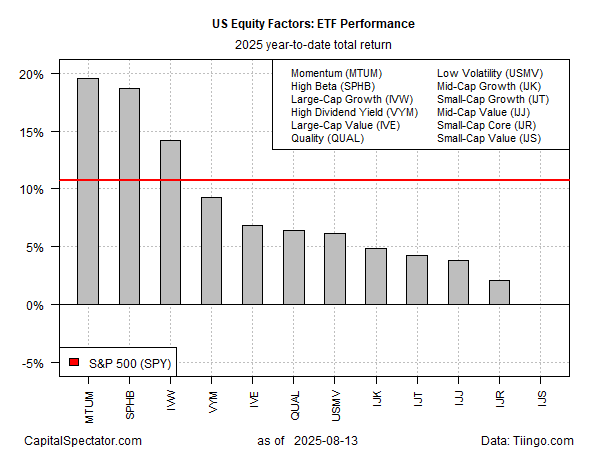

The dominance of the momentum factor roars on. At nearly every step this year, this risk factor has outperformed the broad stock market, based on a set of ETFs through yesterday’s close (Aug. 13). The recent rebound in so-called high-beta stocks has lifted this factor to a strong second-place performer so far in 2025.

The iShares Momentum Factor ETF (MTUM) is the year-to-date leader with a 19.6% return. The Invesco S&P 500 High Beta ETF (SPHB) is nipping at its heels by rallying 18.7% this year. Both funds are posting a hefty return premiums over the broad market, which is up 10.7% this year via SPDR S&P 500 ETF (SPY).

The rest of the factor field is well behind the momentum and high-beta leaders. Even high-cap growth is struggling to keep up. The iShares S&P 500 Growth ETF (IVW) is in third place this year with a 14.2% total return.

The worst-performing factor in 2025: small-cap value (IJS), which is flat on the year–a dismal performance considering the broad-based rally elsewhere. As the once popular small-cap value factor continues to lag, questions persist about the validity of this slice of the small-cap universe. The fund has been a lackluster performer in recent years, and the latest results don’t offer any evidence to suggest a change is in the offing.

By contrast, some of the factor funds are showing renewed strength and are worth keeping an eye on. One ETF that’s looking stronger lately: the high-dividend factor (VYM).

The fund rallied sharply yesterday and closed at a new record high, suggesting that investors’ appetite favors relatively high payouts in equities, perhaps because Wall Street is expecting that the Federal Reserve will start cutting rates next month. In that case, dividend payouts will become more attractive if the competitive yields in bonds declines.

Author: James Picerno