Macro Briefing: 20 August 2025

US housing starts rose to a five-month high in July, led by construction of multi-family units… They stockpiled goods before tariffs kicked in… started levying tariffs of about 15% on dozens of countries… That was on top of China tariffs of 30%…” Widening Treasury yield spreads could be an…

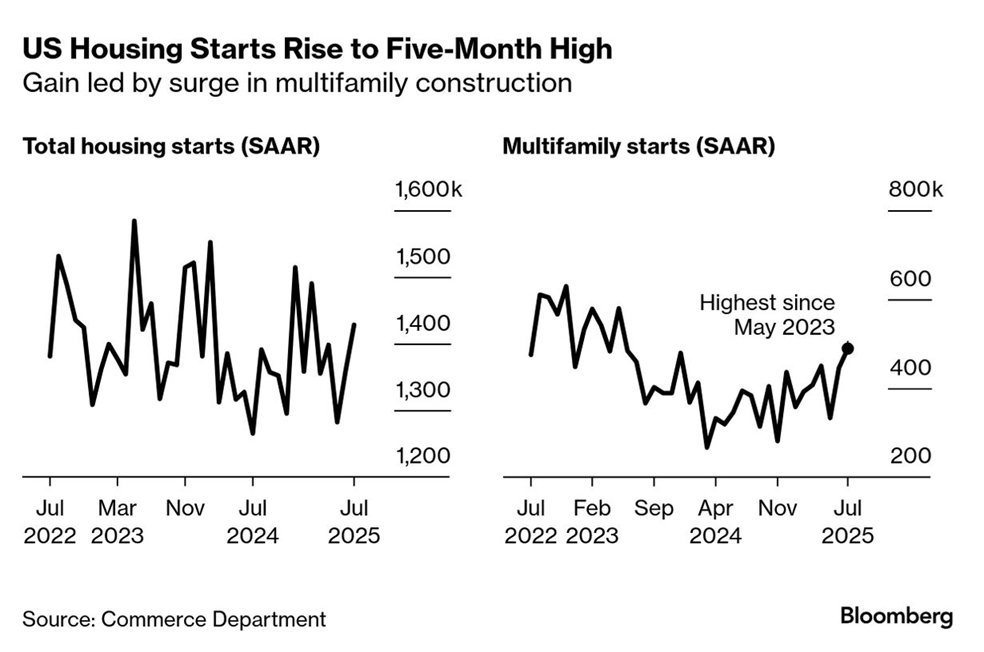

US housing starts rose to a five-month high in July, led by construction of multi-family units. Newly issued permits for housing construction, however, fell to a five-year low, suggesting that the outlook for residential building is still bearish.

Companies are signaling that higher prices are coming, Axios reports. “Companies, fearful that high prices could spook their customers, held the line in the meantime. They stockpiled goods before tariffs kicked in.” But “Reality is biting. At the beginning of the month, the U.S. started levying tariffs of about 15% on dozens of countries. That was on top of China tariffs of 30%.”

Home Depot, a belwether for consumer spending and the economy, has posted a 4.9% rise in sales from the previous year for the second quarter. ““We absolutely saw momentum continue to build in our core categories throughout the quarter,” said the firm’s chief financial officer.

A new era of “fiscal dominance” has arrived, warns Kenneth Rogoff, a professor at Harvard and former chief economist of the IMF. The combination of rising government debt and increased costs is “creating enormous political incentives for governments around the world to put pressure on central banks to lower rates.”

Widening Treasury yield spreads could be an opportunity for investors, but uncertainty on the inflation outlook still suggests caution, advises a note from TMC Research, a unit of The Milwaukee Company, a wealth manager. “The bond market is struggling with deciding if inflation or slower economic growth is the bigger risk,” which leaves room for debate for deciding if its timely to take advantage of a steepening yield curve by holding longer maturities.

Author: James Picerno