Macro Briefing: 9 October 2025

The reasoning: weakness in the labor market… Enthusiasm for artificial intelligence in the stock market is raising concerns about a bubble… “While it appears we are not in a bubble yet, high levels of market concentration and competition in the AI space suggest investors should continue to fo…

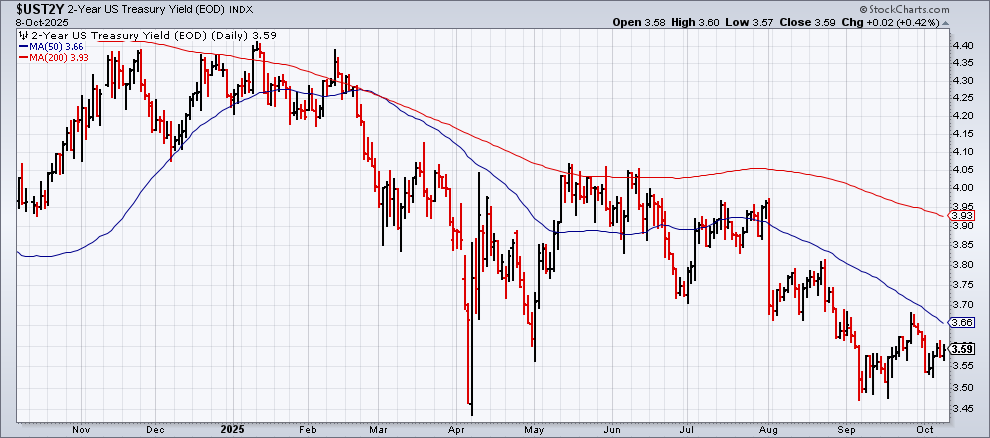

Federal Reserve officials are leaning toward additional interest-rate cuts this year, according to Fed minutes for latest policy meeting. The reasoning: weakness in the labor market. “In considering the outlook for monetary policy, almost all participants noted that, with the reduction in the target range for the federal funds rate at this meeting, the Committee was well positioned to respond in a timely way to potential economic developments,” the minutes stated. Meanwhile, the policy-sensitive US 2-year Treasury yield continues to trade near its low for the year to date.

Consumers expect inflation to be higher in the year ahead, according to the New York Fed’s monthy survey. The regional Fed bank reports: “Median inflation expectations in September increased at the one-year-ahead horizon to 3.4% from 3.2% and at the five-year-ahead horizon to 3.0% from 2.9%.”

China further tightened restrictions on exporting rare earths, which are vital components in a range of consumer and military items. The new rules state that overseas exporters of items that contain even tiny amounts of rare earths sourced from China or manufactured using its rare earth extraction or refining technology must receive an an export license from the country’s Ministry of Commerce.

Enthusiasm for artificial intelligence in the stock market is raising concerns about a bubble. “While it appears we are not in a bubble yet, high levels of market concentration and competition in the AI space suggest investors should continue to focus on diversification,” strategists at Goldman Sachs said in a note.

The risk of a “substantial deterioration” in the housing market was discussed during the latest Fed meeting, according to the minutes for the September 16–17 discussion among central bankers. “Several participants noted continued weakness in the housing market, and a couple of participants mentioned the possibility of a more substantial deterioration in the housing market as a downside risk to economic activity,” the summary stated. Meanwhile, shares of home builders (XHB) are trading near a two-month low.

Author: James Picerno