Macro Briefing: 30 October 2025

The assumption is that AI-related business activity will continue to grow, which is fueling a capital spending boom linked to business opportunities with the technology…President Trump said he would cut tariffs on the China and that Beijing had agreed to allow the export of rare earth elements…

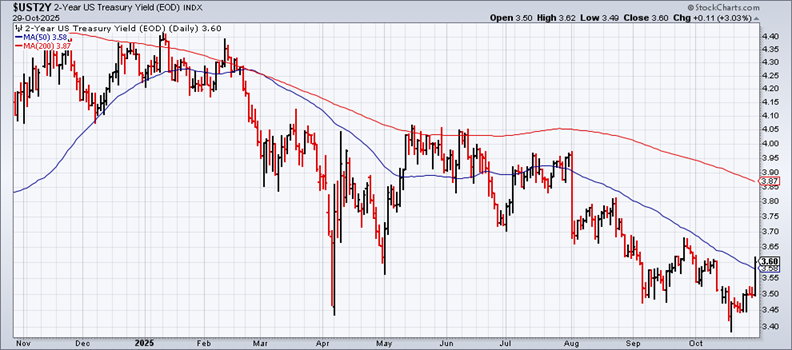

The Federal Reserve cut its target interest rate by 1/4 point on Wednesday, as expected, marking the second time this year the central bank has eased policy. Fed Chair Jerome Powell, in a press conference, raised doubts about a third cut at the next FOMC meeting in December. Treasury yields rose sharply in reaction, including the policy-sensitive 2-year yield, which jumped to 3.60%, a three-week high.

President Trump said he would cut tariffs on the China and that Beijing had agreed to allow the export of rare earth elements and start buying American soybeans. Trump advised that concerns over rare earths to be “settled”, adding that “they’re not going to impose the rare earth controls” for a period of at least one year.

AI chipmaker Nvidia becomes first $5 trillion company as the firm’s stock market valuation continues to rise. To put that in perspective, Nvidia’s value exceeds the GDP of India, Japan and the United Kingdom, according to the International Monetary Fund.

Three of the biggest US tech giants — Microsoft, Meta, and Google — said their ambitious spending on AI infrastructure will continue to accelerate. The assumption is that AI-related business activity will continue to grow, which is fueling a capital spending boom linked to business opportunities with the technology.

ADP’s new weekly job pulse report indicates that the labor market has been strengthening recently. This indicator’s growth in employment suggests that US economy is emerging from its recent trough of job losses, the company advised.

Author: James Picerno