Mixed Economic Signals Complicate Fed Rate‑Cut Path

The labor market, by contrast, paints a weaker profile for economic activity…The optimistic spin is that the slowdown in the labor market may not be the dire signal for the business cycle that it’s been in the past… For now, the outlook is sufficiently cloudy to persuad…

The economy feels like a tale told through fogged‑up glass lately. Pick the “right” indicators and you can argue almost any version of reality. Forecasts are always a little blurry, but this moment feels different — the numbers themselves seem to be hiding the plot.

Let’s start with a top-down view using GDP. To judge by the popular nowcast published by the Atlanta Fed, last year ended with a strong tailwind. The regional Fed bank’s GDPNow model is estimating that the delayed fourth-quarter GDP report (due on Feb. 20) will post a robust 4.2% annualized increase. If correct, the rise will mark three straight quarters of vigorous gains.

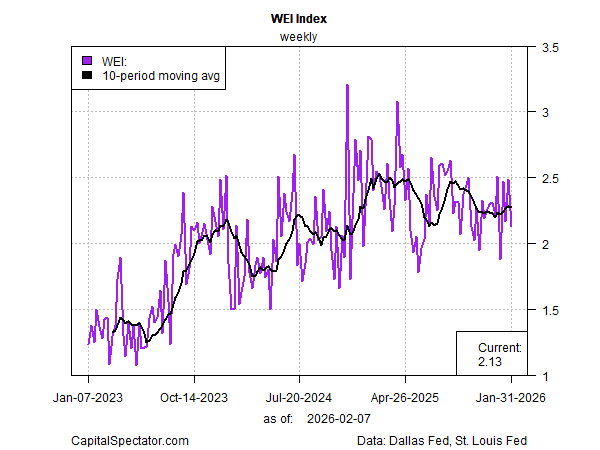

A timelier measure of the economic trend shows that the growth bias has carried over into early 2026, based on the Dallas Fed’s Weekly Economic Index (WEI). Last week’s report indicates that four-quarter GDP growth was holding in the 2%-plus range through Jan. 31, reflecting a moderate trend that’s in line with recent history.

The labor market, by contrast, paints a weaker profile for economic activity. Several updates last week set the tone, starting with ADP’s estimate for private-sector payrolls, which posted a weak 22,000 gain in January. The estimate from Revelio Labs is even weaker, highlighting a modest loss for payrolls last month.

The optimistic spin is that the slowdown in the labor market may not be the dire signal for the business cycle that it’s been in the past. Although there’s no clear verdict yet on what the hiring slowdown really means, one theory is that the labor supply has tightened so much that the breakeven pace of job growth — the monthly gain needed to keep unemployment steady — has dropped sharply. By some estimates, that threshold slid from roughly 100,000–150,000 new jobs a month in recent years to just 30,000–60,000 by late 2025.

Investors will be watching tomorrow’s delayed payrolls update from the government for fresh clarity. The consensus forecast sees hiring at companies picking up, rising 80,000 in January, a solid improvement over December’s stall-speed gain of just 37,000, according to Econoday.com.

Enter the Federal Reserve, which is tasked with deciding if the economy’s slowing to the point that more rate cuts are needed. For now, the outlook is sufficiently cloudy to persuade the market that the Fed will leave rates unchanged at the next two policy meetings in March and April. By June, policy easing will resume, according to Fed funds futures.

The policy-sensitive US 2-year Treasury yield is also watching and waiting, as it trades close to the median Effective Fed Funds rate.

The question is what will move the needle for Fed policy decisions? Weaker-than-expected data for payrolls tops the list, and so Friday’s report could be decisive. After months of a hiring slowdown, clearer signs that the labor market is still cooling could trigger more rate cuts sooner than expected.

Just to keep things interesting, Friday’s report will also reflect routine revisions to the government’s 2025 data. Analysts say the revisions will show the economy minted fewer jobs than previously reported. Not exactly the vibe that the bulls are looking for.

“If you’re not looking so much at GDP and the stock market right now and you’re focusing just on the labor market, it definitely seems like the momentum is skewed toward more risks of a downturn at the moment,” says Cory Stahle, an economist at the Indeed Hiring Lab.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno