US Growth Expected To Moderate In Next Week’s Q4 GDP Report

Recession risk remains low, but the torrid pace of GDP growth in recent quarters is expected to downshift in next week’s delayed fourth-quarter report from the government, based on the median for a set of nowcasts compiled by The Capital Spectator…Wednesday’s better-than-expected payrolls …

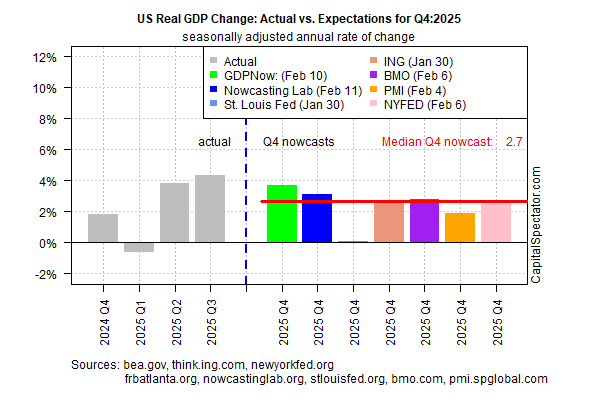

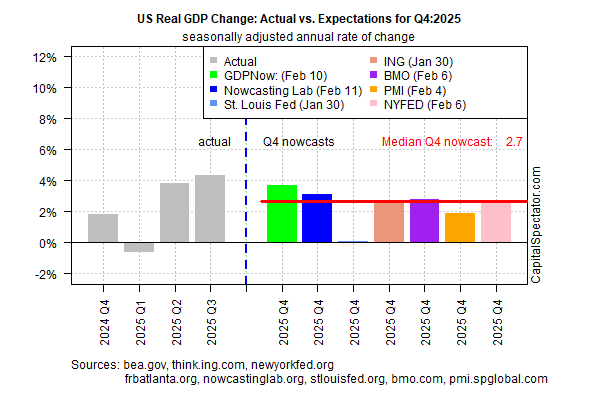

Recession risk remains low, but the torrid pace of GDP growth in recent quarters is expected to downshift in next week’s delayed fourth-quarter report from the government, based on the median for a set of nowcasts compiled by The Capital Spectator.

Today’s update indicates a 2.7% annualized increase in GDP, unchanged from the previous estimate. If accurate, output will ease following from Q3’s 4.4% pace, a two-year high.

The upside outlier in the data sets in the chart above remains the Atlanta Fed’s GDPNow model. Note that the regional Fed bank’s nowcast has been revised lower in recent weeks and is currently estimating a 3.7% advance (as of Feb 10). That’s still a solid gain, but here too the view has cooled lately and that the economy is expected to expand at the slowest rate in the past three quarters.

Whatever next week’s numbers reveal, it’s likely that the Q4 data will confirm that the US ended 2025 with an economic tailwind. Analysis in our sister publication this week – The US Business Cycle Risk Report – highlights a persistently moderate growth pace through January, based on a broad set of business-cycle indicators.

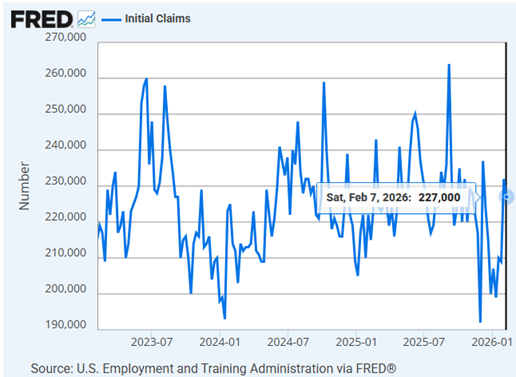

Wednesday’s better-than-expected payrolls report for last month strengthens the view that the economy remains resilient, at least in relative terms. As a result, the recession warnings from some economists late last year still look wide of the mark.

A low pace of layoffs via jobless claims data supports the view that the labor market is stabilizing after downshifting in last year’s second half.

There are several caveats to consider with the latest payrolls numbers, including downward revisions that show that hiring last year was substantially than previously estimated. Another issue: last month’s increase in payrolls was highly dependent on healthcare, which suggests that the cyclical parts of the economy could falter as the year rolls on.

“The surprisingly strong job gains in January were driven mainly by health care and social assistance,” says Heather Long, chief economist at Navy Federal Credit Union. “But it is enough to stabilize the job market and send the unemployment rate slightly lower. This is still a largely frozen job market, but it is stabilizing. That’s an encouraging sign to start the year, especially after the hiring recession in 2025.”

Another economist offers a similarly upbeat diagnosis: “The signal from the US labor market is that we’re nowhere near recession,” writes Robin Brooks, senior fellow at the Brookings Institution and former chief economist at Institute of International Finance. “There’s really no indication that the US economy is rolling over. If anything, the labor market says activity is picking up.”

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno