US 10-Year Treasury Yield Continues To Trade Near “Fair Value”

In line with recent history, the benchmark 10-year yield remained close to its “fair value” estimate in January, based on the average of three models run by CapitalSpectator… Previously, the 10-year yield traded significantly above fair value for several years… Despite the modest increase…

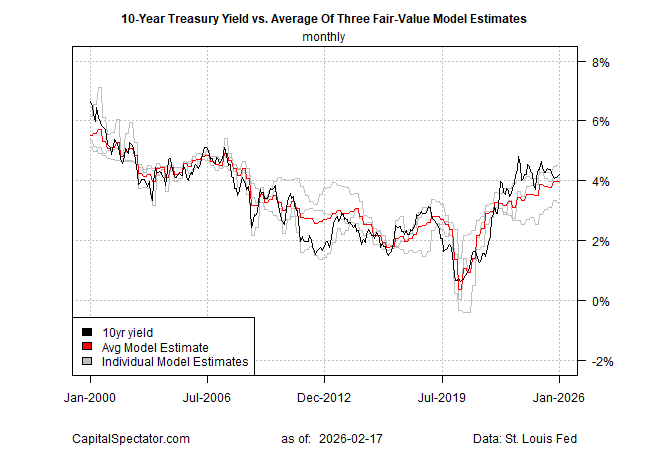

In line with recent history, the benchmark 10-year yield remained close to its “fair value” estimate in January, based on the average of three models run by CapitalSpectator.com.

The near-neutral pricing, reflecting a modest premium in the market rate, has been a feature over the past five months. Previously, the 10-year yield traded significantly above fair value for several years.

The premium in the market rate was 25 basis points in January, based on analytics using monthly data. That’s up slightly from December’s premium and marks a five-month high. Despite the modest increase, the current premium remains close to fair value and extends the recent shift toward a near alignment between the market rate and the average model‑derived theoretical value.

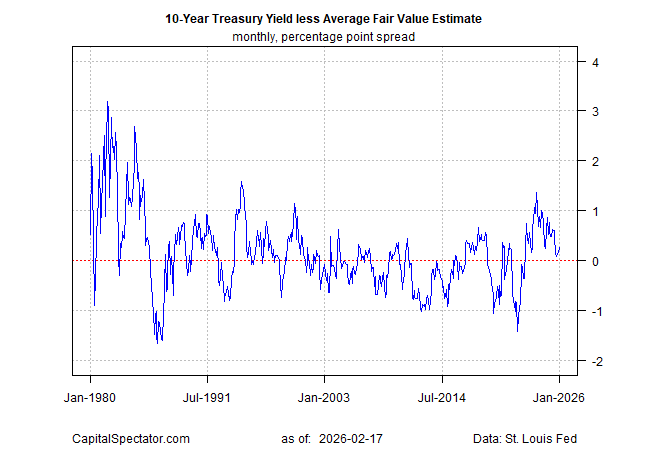

The track record of the deviation in the market rate vs. the average fair value estimate offers an implied forecast. The quasi-random behavior of the spread, as it varies around zero through time, suggests that the relationship between the market rate and fair value isn’t persistent. In turn, that implies that when the spread is relatively wide, either negative or positive, a mean reversion is likely at some point.

Timing is always uncertain, but the spike in the previous spread well above +1 percentage point inferred that the difference would narrow, either through a decline in the market rate, a rise in the fair value estimate, or some combination of both. In Oct. 2023, when the spread had reached a multi-decade high, CapitalSpectator.com wrote: “The spread is now at the 95th percentile, based on history since 1980. That implies that we’re near the peak [for the spread].”

More than two years later, the spread has dropped sharply and returned to a near-neutral level. The adjustment has been a function of a rising fair-value estimate and a falling 10-year yield, which closed last week at 4.04% (Feb. 13), which is nearly a full percentage point below the near-5% level the benchmark rate briefly approached in market trading in Oct. 2023.

Author: James Picerno