US Q4 Growth Set To Extend Streak As K-Shaped Risk Lurks

The US economy is on track to report a third straight quarter of growth in tomorrow’s delayed GDP update for Q4, based on the median of a set of nowcasts compiled by The Capital Spectator…Although the top-line measure of economic activity is expected to chug along at a solid pace for a third…

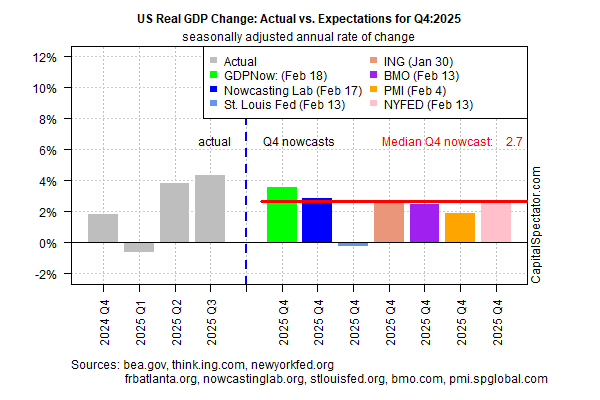

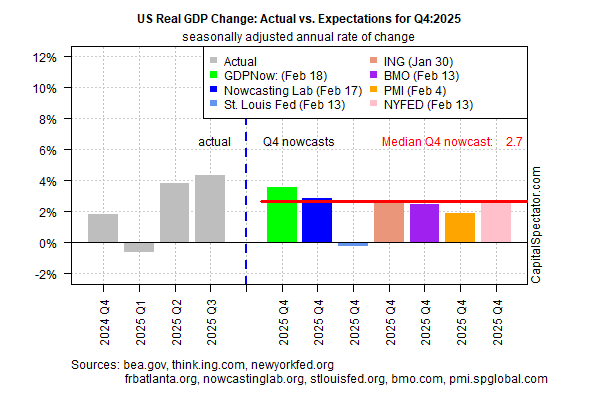

The US economy is on track to report a third straight quarter of growth in tomorrow’s delayed GDP update for Q4, based on the median of a set of nowcasts compiled by The Capital Spectator. The pace is expected to slow from Q3, but the increase will be strong enough to keep last year’s chatter about recession on the fringes of economic analysis.

Today’s revised estimate shows output in the previous quarter rose 2.7% at an annualized rate for GDP, unchanged from the previous estimate. If this median nowcast is accurate, growth will downshift from Q3’s strong 4.4% advance, which marked a two-year high.

An encouraging sign is the relatively steady run of median nowcasts lately, following several upward revisions. Nearly a month ago, the median estimate was 2.1%, which was revised up earlier this month and is holding at 2.7% ahead of tomorrow’s release from the Bureau of Economic Analysis.

The widely followed GDPNow estimate from the Atlanta Fed remains the upside outlier, currently nowcasting a 3.6% increase. Using this outlook as a guide in context with our median nowcast implies that a high-2%-to-low-3% increase is a reasonable assumption for tomorrow’s release.

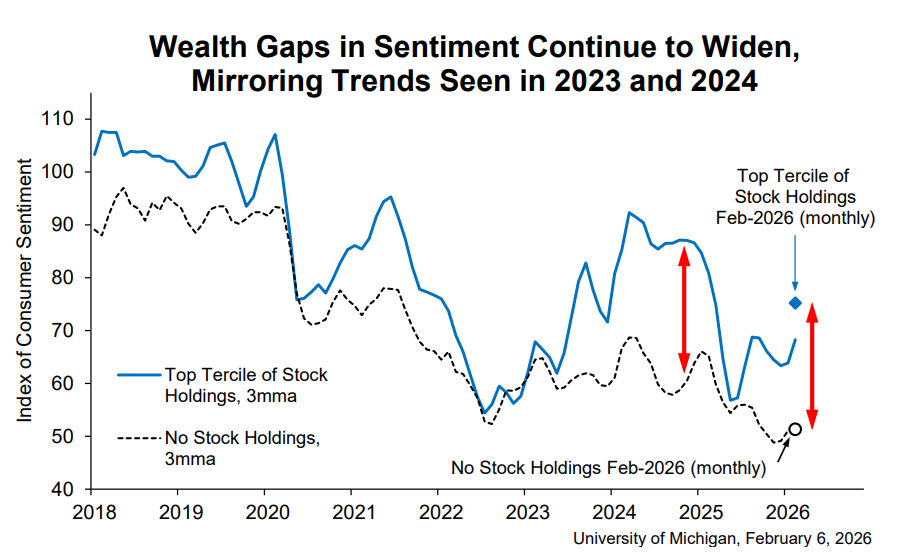

Although the top-line measure of economic activity is expected to chug along at a solid pace for a third straight quarter, there are growing concerns about the so-called K-economy effect – a reference to an uneven economy across sectors and households. For example, a substantial gap in consumer sentiment has opened up between consumers with equity investments compared with households with little or no stock holdings. “Sentiment surged [in February] for consumers with the largest stock portfolios, while it stagnated and remained at dismal levels for consumers without stock holdings,” survey director Joanne Hsu said.

The gap between high and low earners “leaves the economy much more sensitive,” said Samuel Tombs, chief US economist at Pantheon Macroeconomics. “It’s almost like the stock market is the tail that’s wagging the dog of the economy,” added Emily Roland, co-chief investment strategist at Manulife John Hancock Investments.

The implication: a sharp fall in the stock market could have outsized effects on the economy. That’s a risk for 2026, but the threat is expected to remain muted in tomorrow’s GDP update.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno