Bubble Watch: S&P 500 Edition | 05 March 2024

When the stock market enjoys a strong bull run, the bubble warnings come out of the woodwork… But obsessing over bubble talk can also lead to temporary insanity…Even if we can design a near-flawless bubble-watch metric, which is almost certainly impossible, there’s an added complication…

You can almost set your watch to it. When the stock market enjoys a strong bull run, the bubble warnings come out of the woodwork. That’s not to disparage a healthy discussion about overbought and oversold conditions. Markets go to extremes, of course, and so keeping an eye on the outlier events can be productive because current conditions provide context for estimating expected return. But obsessing over bubble talk can also lead to temporary insanity. Finding the sweet spot is the trick.

Even if we can design a near-flawless bubble-watch metric, which is almost certainly impossible, there’s an added complication: how timely is it? As the saying goes, the market can remain irrational for longer than you can stay liquid.

But fear not: going down this rabbit hole can be useful, if used in moderation and in context with other portfolio-management tools. The goal is developing more confidence in the delicate art of managing expectations, ideally based on numbers and models vs. the headline du jour. There’s always some degree of qualitative judgment required, but the more you can cite data, the less prone to behavioral risk you’ll be. That’s no silver bullet — the future’s still uncertain. But it’s a reasonable way to proceed.

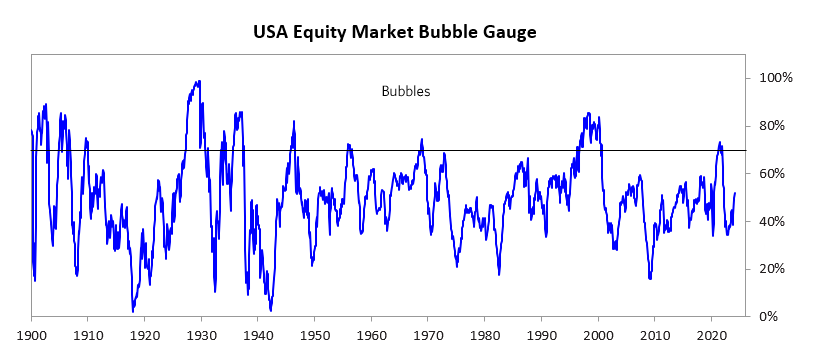

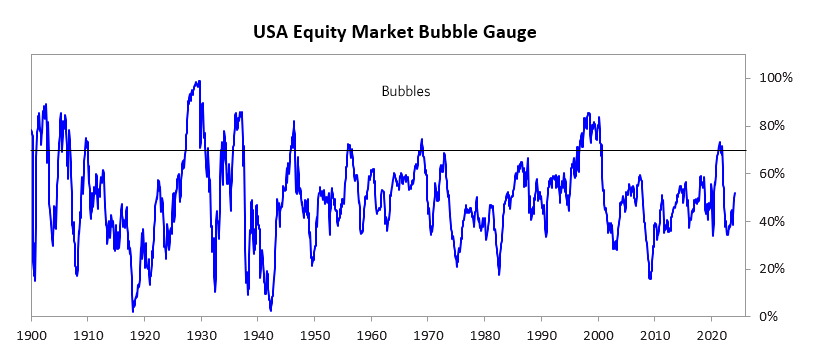

For some perspective, let’s start with Ray Dalio’s commentary from last week, when he argued that “the US stock market doesn’t appear to be in a bubble.” Citing a multi-factor proprietary metric, the founder of investment firm Bridgewater Associates explained: “When I look at the US stock market using these criteria (see the chart below), it—and even some of the parts that have rallied the most and gotten media attention—doesn’t look very bubbly. The market as a whole is in mid-range (52nd percentile). As shown in the charts, these levels are not consistent with past bubbles.”

Bubbles, however, are in the eyes of the beholder and it’s easy to find disagreement among analysts. For example, Kenneth Rogoff, professor of economics and public policy at Harvard University, is baffled at the stock market’s recent strength. “Given the challenges and uncertainties facing both the US and global economies, it is difficult to see how the current stock market boom can last,” he writes.

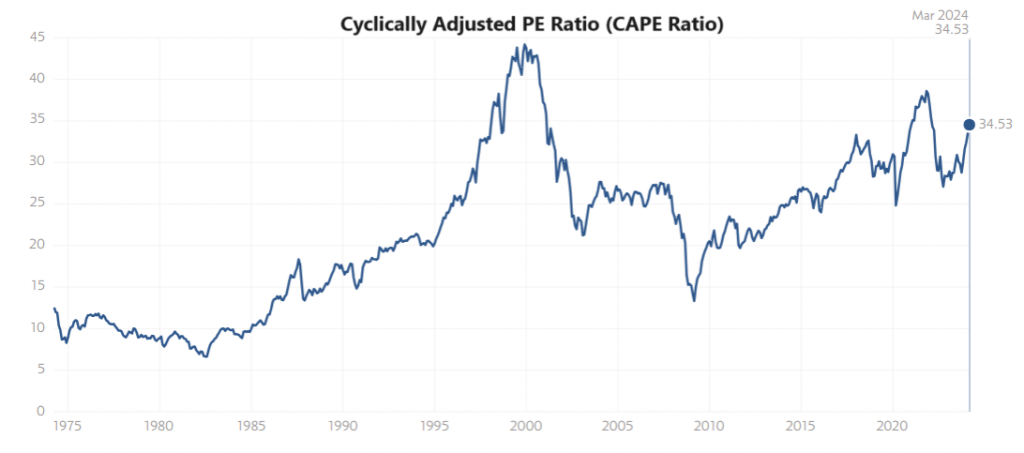

Meanwhile, The Wall Street Journal observes: “The case for stocks being frothy isn’t hard to make.” Using the CAPE ratio as a proxy for market valuation certainly suggests that the crowd is pricing equities at an elevated rate relative to the previous trough.

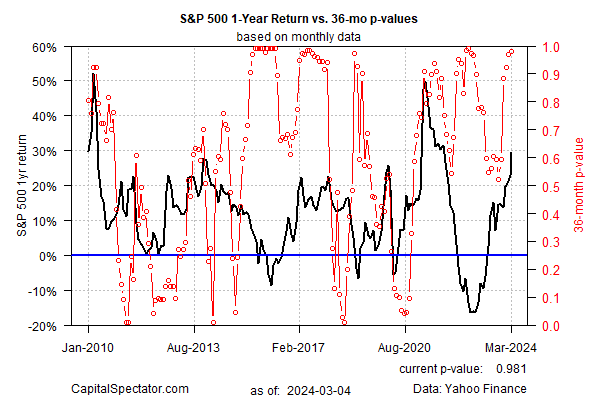

CapitalSpectator.com’s home-grown effort to quantify bubble risk certainly looks worrisome as the current reading approaches the 99th percentile.

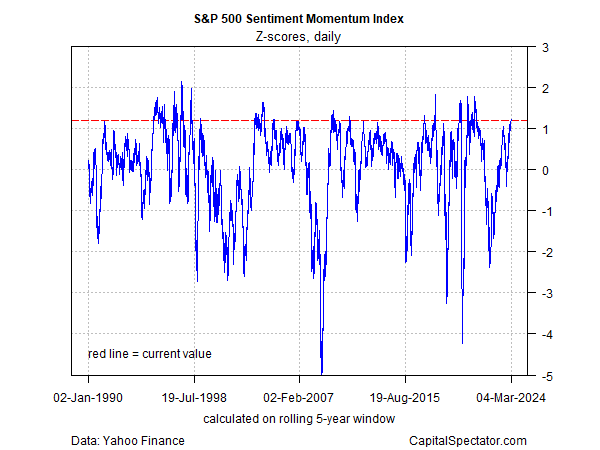

Another indicator forged on these pages also suggests the market is flirting with, if not already in, overbought terrain via the S&P 500 Sentiment Momentum Index (for design details see this summary).

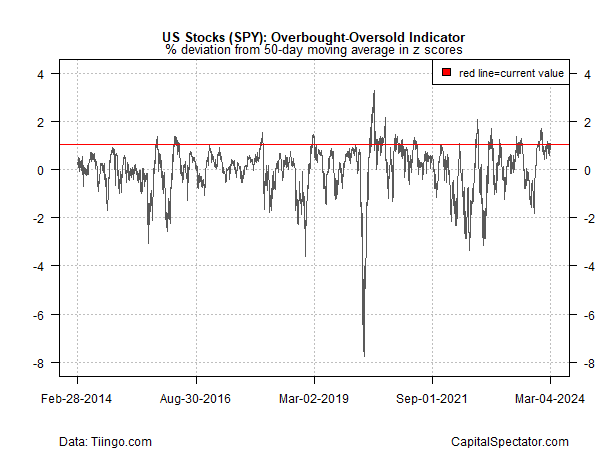

A relatively simple gauge of market momentum also suggests that animal spirits have gone too far too fast.

What to make of all this? Alas, there are no generic (or easy) answers. Different investors with different investment strategies can reach different conclusions. For a long-term buy-and-hold investor with more an investment horizon that’s at least 5 years, it’s reasonable to look through the current bout of hand-wringing. At the opposite extreme, investors with short horizons, a low risk tolerance, and near-term requirements for liquidity may want to be relatively cautious at this point.

A good place to start with deciding what’s appropriate: What is the portfolio saying? Has the portfolio blown through the target equity weight and is in currently in nosebleed territory? Or is the portfolio, despite the recent rally, below target for equities?

Having those numbers in hand can help minimize the guesswork on what’s appropriate, and what’s not in terms of rebalancing decisions. Then again, for some folks the first order of business is developing a still-missing equity target allocation. If that basic task remains on your list of things to do, congratulations – you have full clarity about the next step and it has nothing to do with reading bubble-risk tea leaves.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno