Floating-Rate And Junk Bonds Lead Fixed Income So Far In 2024

Within the fixed-income space a degree of relative resilience persists for floating-rate securities, low-rated loan securities and junk bonds, based on year-to-date performance via a set of ETFs through Tuesday’s close (Mar… Nipping at FLRN’s heels in second- and third-place: a bank-loan ETF …

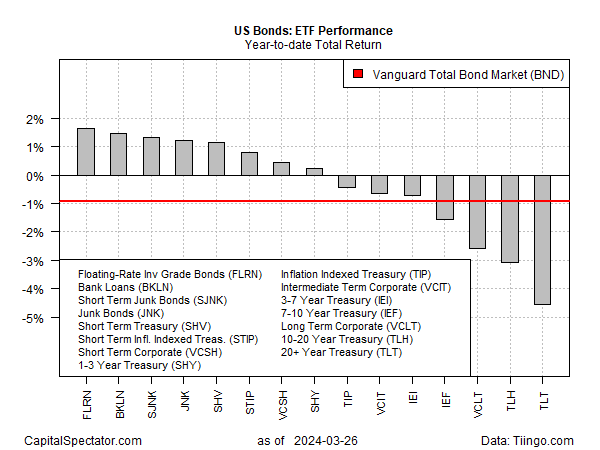

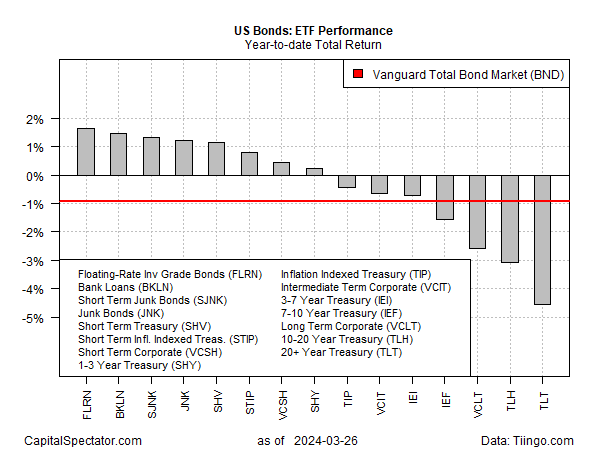

The bond market has struggled to fully recover from the Federal Reserve’s aggressive run of interest-rate hikes in 2022-2023, but pockets of strength remain conspicuous. Within the fixed-income space a degree of relative resilience persists for floating-rate securities, low-rated loan securities and junk bonds, based on year-to-date performance via a set of ETFs through Tuesday’s close (Mar. 26).

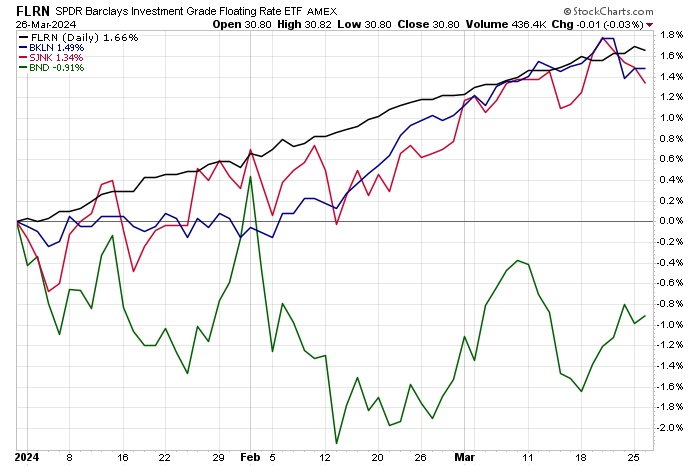

The top performer in 2024 for our US bond opportunity set: SPDR Bloomberg Investment Grade Floating Rate ETF (FLRN), which is up 1.7% so far this year. Nipping at FLRN’s heels in second- and third-place: a bank-loan ETF (BKLN) and short-maturity junk bonds (SJNK), which are posting positive year-to-date results just slightly behind FLRN’s gain.

This trio of ETFs continue to outperform the negative performance for a broad investment-grade benchmark for US fixed-income securities (BND) by a wide margin this year.

The headwind for bonds generally, of course, is closely linked to ongoing uncertainty about when the Fed will start cutting interest rates. As market expectations wax and wane on this forecast, most corners of fixed-income have suffered recently. But some analysts advise that the weakness in many bond sectors has created opportunity because lower fixed-income prices coincide with higher yields.

“Yields are still attractive,” says Mike Cudzil, a fixed-income portfolio manager at Pimco.

That may be true for buy-and-hold investors purchasing individual bonds, but from a price-trend perspective via ETFs it’s less obvious and therefore less compelling (at least from a behavioral perspective and assuming that holders of individual bonds don’t monitor prices). Consider how an ETF of medium-term Treasuries (IEF) stacks up in recent history. As the weekly chart below reminds, the jury’s still out on whether the bear market in government bonds has run its course. The recent bounce lends hope that IEF has bottomed, but the ebb and flow of expectations for Fed decisions on monetary policy remains a headwind for an extended rally.

But perhaps the tide is turning. Market sentiment is again pricing in relief in the form of rate cuts, starting at the June FOMC meeting. Fed funds futures this morning estimate a roughly 70% probability that the central bank will trim its current 5.25%-to-5.50% target rate on June 12.

But as the IEF chart above suggests, the Treasury market isn’t fully convinced that the start of a dovish policy regime is near, much less started. The main reason: sticky inflation news in recent months.

But there’s a competing factor that may yet win the day and overcome the Fed’s reluctance to cut rates: a slowing US economy.

The question is whether a softer economic trend will overcome sticky inflation in the near term and keep the Fed on track to starting cutting rates. Based on the Treasury market’s trend of late (based on IEF), estimating the odds for either path still looks like a coin toss.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno