Foreign Bonds Are Having A Very Good Year In US Dollar Terms

A new report from investment consultancy bfinance suggests that global economic shifts — including a weakening US dollar and evolving trade dynamics – favor the outlook for local currency emerging market debt:“Today, the profound macroeconomic shifts reshaping global capital m…

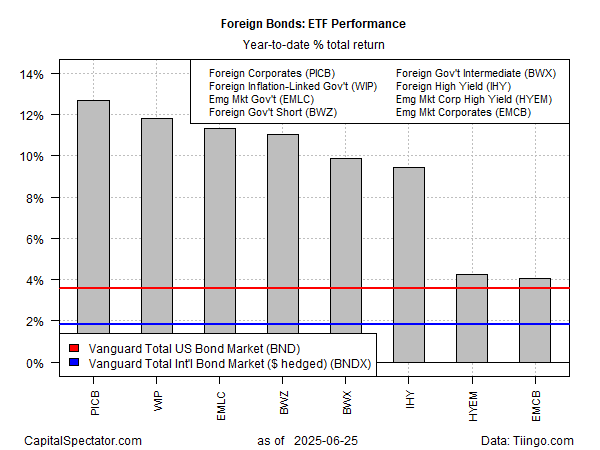

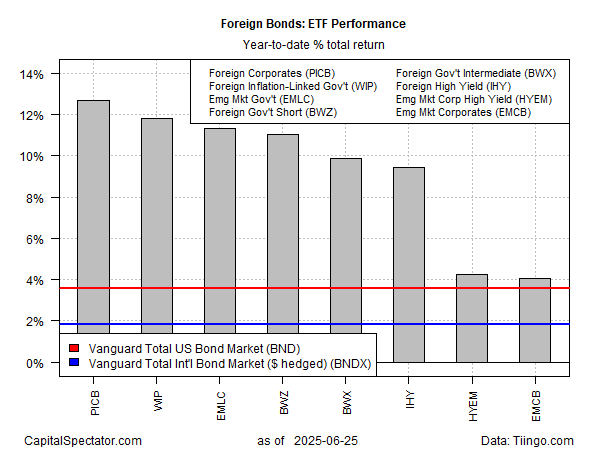

In line with the strong rally in foreign equities year to date, bond markets ex-US are also posting solid gains, based on a set of ETFs through Wednesday’s close (June 25).

Foreign corporate bonds are leading the international fixed-income field so far in 2025. The Invesco International Corporate Bond ETF (PICB) is up 12.7% this year – far ahead of the relatively modest 3.8% gain for US corporates (LQD) and the 3.6% year-to-date increase for the US investment-grade government/corporate benchmark (BND).

A key factor in the strong fixed-income returns ex-US in 2025 is the weak US dollar, which has fallen 8.0% year to date based on an ETF proxy for the greenback (UUP). All things equal, foreign assets priced in non-dollar currencies rise in US dollar terms when the American currency fall, a factor that’s provided a powerful tailwind lately.

Another driver of strong offshore bond prices is the trade war. The sharp rise in US tariffs has sparked renewed interest in strategies that favor global diversification and reduce allocations to US dollar assets.

“Suddenly, it makes emerging market local currency debt great again,” said Damien Buchet, chief investment officer of Principal Finisterre, in an interview with Financial Times this week. In the same article, Kevin Daly, co-head of CEEMEA economics at Goldman Sachs, observed: “Emerging market local currency assets had been underinvested for a number of years,” said Kevin Daly, co-head of CEEMEA economics at Goldman Sachs. “Even small inflows are having arguably disproportionately large effects.”

The inflows are certainly supporting VanEck JP Morgan EM Local Currency Bond ETF (EMLC), which closed on Wednesday at a four-year high.

A new report from investment consultancy bfinance suggests that global economic shifts — including a weakening US dollar and evolving trade dynamics – favor the outlook for local currency emerging market debt:

“Today, the profound macroeconomic shifts reshaping global capital markets – including the changing role of the US and the US dollar in the geopolitical and economic world order – are prompting investors to re-examine their approach to the asset class, whether this stems from an impetus to re-evaluate the overall size of the allocation or the types of strategies used to provide exposure.”

Author: James Picerno