Inflation Anxiety And The “Big Beautiful Bill”

A key issue for markets is how, or if, the legislation will be amended with respect to projections that, if passed, the bill will deepen an already hefty federal deficit in the years ahead and thereby stoke inflation concerns as the government’s borrowing needs increase…”Meanwhile, three …

The mega spending bill that the House passed now awaits debate in the Senate. A key issue for markets is how, or if, the legislation will be amended with respect to projections that, if passed, the bill will deepen an already hefty federal deficit in the years ahead and thereby stoke inflation concerns as the government’s borrowing needs increase.

“I’m hoping now we’ll actually start looking at reality,” said Sen. Ron Johnson (R-Wis.). “I know everybody wants to go to Disney World, but we just can’t afford it.”

BBC reports: “At present, the US deficit – the difference between what the government spends and how much it collects in taxes – is $1.9 trillion. The tax cuts proposed in Trump’s bill could add $3.8 trillion to the deficit over the next decade, according to the Congressional Budget Office.”

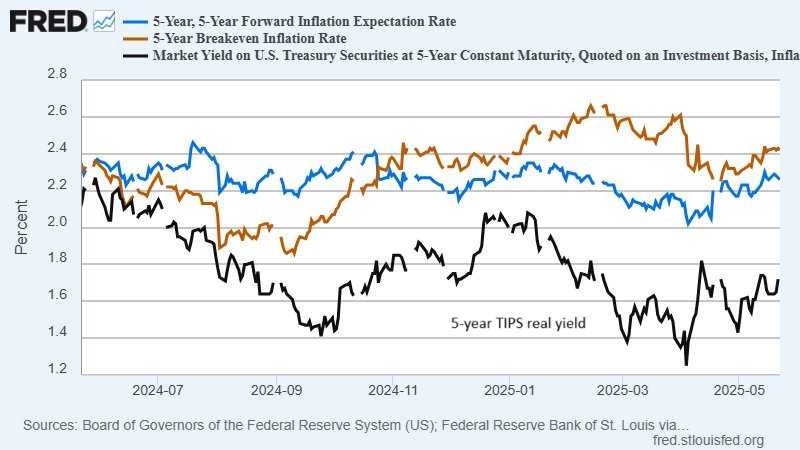

Meanwhile, three key market indicators deserve close attention for real-time feedback for inflation expectations:

- The Treasury market’s inflation-indexed 5-year yield

- The 5-Year breakeven inflation rate

- The 5-Year, 5-Year Forward Inflation Expectation Rate

All three inflation metrics have been trending up lately but remain middling relative to recent history. An upside breakout by one or more of these yields would be a sign that an already anxious market is becoming more concerned about inflation.

“Longer term, yeah, [the spending bill] blows out the deficit. Long term, for the market, it’s bad news. Yields are going higher, which means prices are going down because Treasuries are becoming incrementally less appealing and trustworthy, as our budget deficit stays extremely high for a very long period of time with no signs of it going back to normal,” said Jed Ellerbroek, portfolio manager at Argent Capital Management.

Although investors can debate the merits of Ellerbroek’s analysis, market data is another story. If the inflation indicators continue rising and take out previous highs, the writing will be on the wall. Meantime, the ball is in the Senate’s court.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno