Is Fed Policy Still Too Tight?

But waiting for clear signs could risk the Fed’s success to date in taming inflation without damaging economic growth…For perspective, let’s start with a simple overview of how current policy compares with headline consumer inflation plus unemployment, which together can be used as a pr…

The next round of central bank decisions could rank among the most challenging in recent history, perhaps in decades. Policy hawks and doves can cite a fair amount of evidence for supporting their respective views. The deciding factor, as usual, will be the incoming data. But waiting for clear signs could risk the Fed’s success to date in taming inflation without damaging economic growth. On the other hand, one can argue that policy is still too tight for an economy that appears to be slowing, albeit modestly.

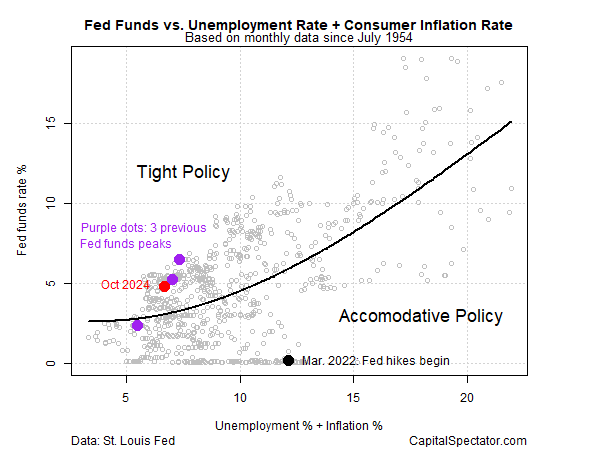

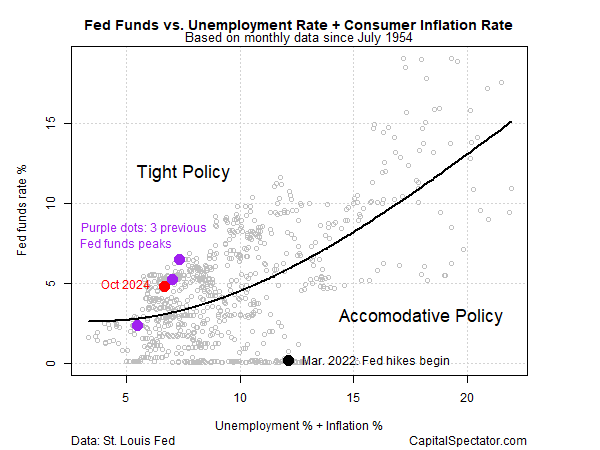

For perspective, let’s start with a simple overview of how current policy compares with headline consumer inflation plus unemployment, which together can be used as a proxy for the central bank’s dual mandate for minimizing inflation and maximizing employment. After two rounds of rate cuts that have trimmed the Fed funds target rate by 75 basis points to the current 4.50%-to-4.75% range, policy still appears to be moderately tight as of October 2024, per the chart below. The implication: there’s still room for another rate cut.

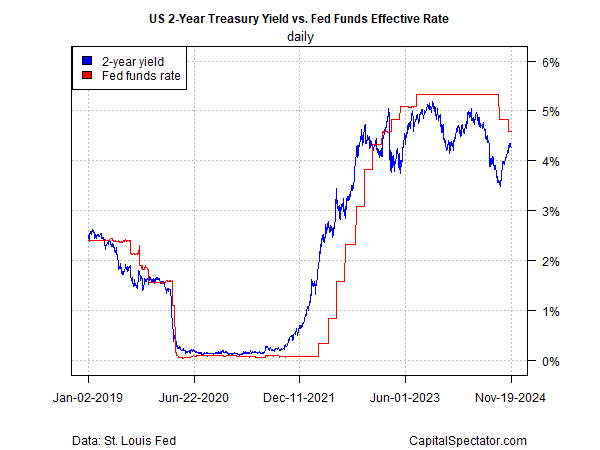

The policy-sensitive 2-year Treasury yield agrees. The widely followed yield, which ticked down on Tuesday (Nov. 19) to 4.27%, continues to trade below the Fed funds target range. The gap is considered a proxy for market expectations favoring another rate cut. Note, however, that the negative spread has narrowed sharply over the past two months and is currently a modest -31 basis points, which suggests a quarter-point rate cut at next month’s policy meeting is reasonable, based on this measure of market expectations.

Fed funds futures are currently pricing in a 59% implied probability for a ¼-point cut at the Dec. 18 FOMC meeting. That’s hardly a confident reading and so it’s the crowd’s view that a coin toss sums up the outlook for the next policy announcement.

The dilemma for the Fed is that the latest consumer inflation data suggest pricing pressure has turned sticky and so its premature to cut rates again. Headline and core readings of CPI turned up in year-over-year terms through October, raising concerns that headwinds may be building for reaching the Fed’s 2% inflation target.

Roiling the outlook is president-elect Trump’s plans for sharply raising import tariffs, which many economists predict would raise inflation.

Meanwhile, several nowcasts for US economic growth in the fourth quarter point to an ongoing if gradual slowdown. The Atlanta Fed’s GDPNow model, for instance, is currently nowcasting a downtick to +2.6% for Q4. That’s still a respectable pace, but it’s one of several signs that suggest a downshift in output is unfolding.

On the other hand, some forecasters say that Trump’s preference for lowering taxes and deregulation will lift growth in 2025, once his policies are implemented, which is a safe bet with Republicans controlling both chambers of Congress.

But there’s a complication: the federal government’s growing fiscal deficit could be an inflationary wild card that further complicates the analytics.

The danger for the Fed is that there are two scenarios that the economy could take in 2025, each differing from the other by a non-trivial degree. The problem is that uncertainty about the year ahead has spiked. Meanwhile, the Fed will be forced to make a calculated risk one way or another sooner rather than later.

The Fed heads, however, are trying to project confidence for what may be an increasingly tricky future. Kansas City Fed President Jeffrey Schmid on Tuesday said that “The decision to lower rates is an acknowledgement of the … growing confidence that inflation is on a path to reach the Fed’s 2% objective.” In addition: “large fiscal deficits will not be inflationary because the Fed will do its job” to keep inflation at the 2% target.

What does doing its “job” mean exactly for what’s shaping up to be a pivotal year ahead on several fronts? Tune in to next month’s policy meeting for something approximating an answer.

Author: James Picerno