Is The Prospect For Another Fed Rate Cut Fading?

The lower 2-year rate is widely viewed as a sign that the market is still anticipating a rate cut… At one point in mid-September the 2-year yield was nearly 180 basis points below the Fed funds rate – a sign that the market is confident on the outlook for rate cuts… The market is still bettin…

The backup in Treasury yields may be a warning sign that the odds are slipping that the Federal Reserve will cut interest rates again at the next policy meeting on Nov. 7.

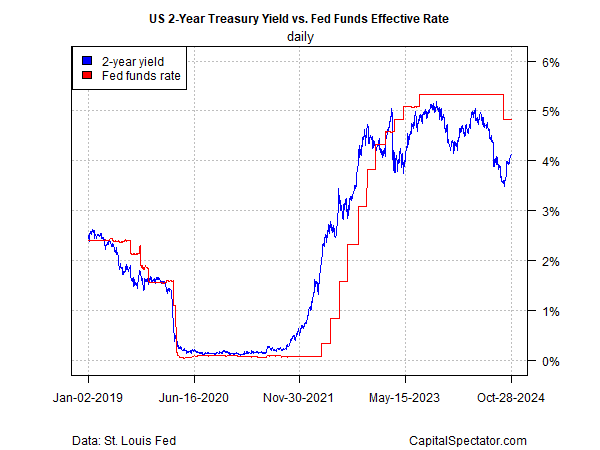

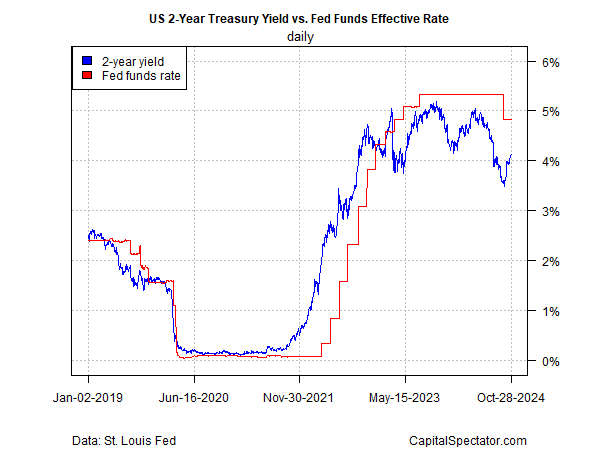

The policy-sensitive 2-year yield closed at 4.15% on Monday (Oct. 28), the highest since Aug. 1. The pushback is that the recent rise in yields is still moderate following a sharp slide in September.

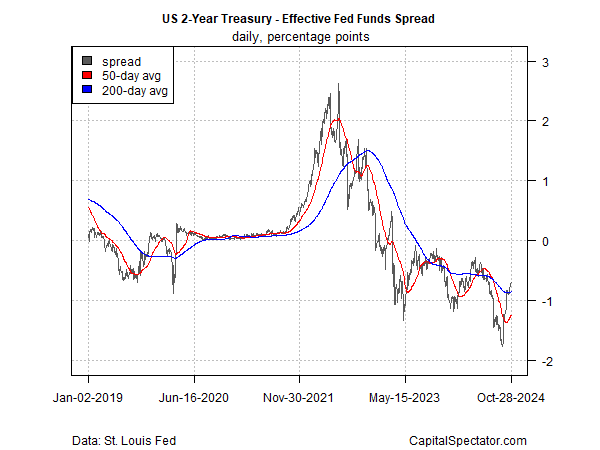

One reason for cautious optimism for expecting more easing: the 2-year rate, which is widely seen as a proxy for policy expectations, continues to trade well below the current Fed funds effective rate range of 4.75%-5.0%. The lower 2-year rate is widely viewed as a sign that the market is still anticipating a rate cut.

Nonetheless, the recent rise in the 2-year yield has dramatically narrowed the spread relative to Fed funds. At one point in mid-September the 2-year yield was nearly 180 basis points below the Fed funds rate – a sign that the market is confident on the outlook for rate cuts. As of yesterday’s close, by contrast, the spread narrowed to a negative 71 basis points. The market is still betting on a rate cut, in other words, but confidence has waned.

Fed funds futures, by contrast, have barely wavered in the outlook for easing. As of early trading this morning, this market is still pricing in an implied 90%-probability that the Fed will cut its target rate by 25-basis points next month.

The hope is that the mixed signals from markets may be resolved after this week’s economic reports. The highlights: Thursday’s release of personal income and spending data for September and the government’s initial estimate of third-quarter GDP. On Friday, markets will focus on the Labor Department’s payrolls report for October.

The glitch is that October labor market data could be distorted by temporary factors. “After two hurricanes, a strike, and rolling furloughs, we anticipate a lot of noise” in Friday’s October employment report,” RBC Capital Markets’ Michael Reid wrote in a note to clients last week.

The economics team at Jefferies agrees: “The distortions to this data make the report difficult to rely on, and we doubt that the Fed will be motivated to change tack on policy based on the tone of the data. Similarly, the drag in October will likely be reversed in November, so we doubt we will have a clean look at the payroll data for the next few months.”

Author: James Picerno