Is The Relatively Weak Trend For US Private Payrolls A Warning?

If you could only track one economic indicator to monitor the economy the trend in payrolls would be a solid choice…The year-over-year trend in private payrolls less total nonfarm payrolls is usually positive, which is to say that the private sector’s hiring tends to dominate… Indeed, th…

If you could only track one economic indicator to monitor the economy the trend in payrolls would be a solid choice. Think of it as the fuel that powers consumer spending engine, which accounts for nearly 70% of economic activity. The good news is that the labor market still looks solid, based on several conventional metrics. But an alternative indicator your editor is watching introduces a degree of doubt about what may be in store for 2025.

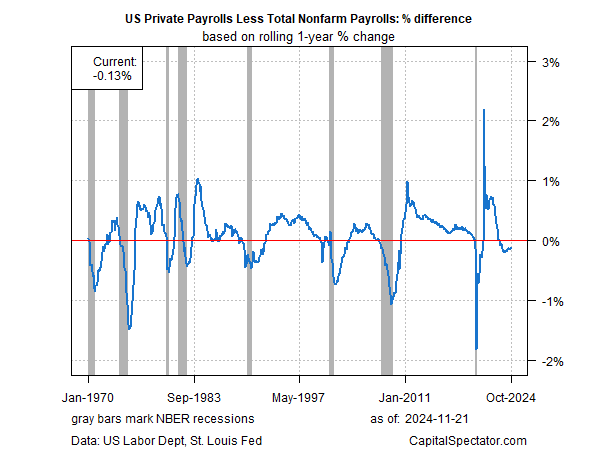

The year-over-year trend in private payrolls less total nonfarm payrolls is usually positive, which is to say that the private sector’s hiring tends to dominate. Indeed, the private sector accounts for about 85% of total payrolls. Hiring and firing by companies, in short, is the critical factor from a business cycle perspective vs. the minor role for government payrolls. As a result, you can learn a lot by comparing the one-year trend in private vs. total, as the chart below suggests.

The key takeaway: when the spread for private less total turns negative, the shift tends to coincide with weak economic conditions that often equate with recession. The exception to the rule is the current run of negative readings.

The private/total spread has been negative for 19 straight months. History suggests the economy should be in a recession, according to this metric. But the economy is still expanding at a healthy pace, which looks set to continue in the fourth quarter.

In fact, other labor-market indicators have been signaling elevated risk – the Sahm rule, for instance. The question is why some labor market indicators are signaling trouble while the broader economy continues to hum?

The stock answer is that the macro upheaval from the pandemic has introduced a higher degree of noise in some indicators and business-cycle analytics generally. All the more reason to model recession risk with a broad set of indicators for modeling recession risk, a methodology that’s proven to be relatively reliable, even in the post-pandemic period.

At the same time, the weak private/total spread is telling us that the labor market appears vulnerable. Vulnerable to what and when? Unclear, but it’s obvious that the sizzling recovery in payrolls that prevailed from roughly mid-2021 through Q1:2023 has faded into relatively weak trend. To date, that’s had a limited impact on the broader economy and not much is expected to change in the immediate future.

Dismissing the negative private/total spread as irrelevant is a step too far. If the spread doesn’t soon rebound into positive terrain it could be an early warning sign for 2025. Timing is open for debate, but it’s hard to imagine that a relatively weak trend in private hiring can persist without some meaningful blowback.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno