Low-Volatility Strategy Is 2025’s Upside Outlier For Equity Factors

Standing alone among US equity factors this year, the low-volatility strategy is holding on to a modest gain year to date… In sharp relief, the rest of the factor field is posting varying degrees of loss, based on a set of ETFs through yesterday’s close (Apr… All the other factor ETFs are also…

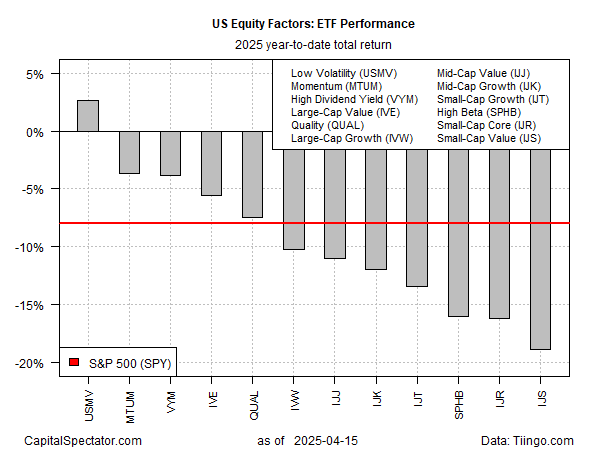

Standing alone among US equity factors this year, the low-volatility strategy is holding on to a modest gain year to date. In sharp relief, the rest of the factor field is posting varying degrees of loss, based on a set of ETFs through yesterday’s close (Apr. 15).

The iShares MSCI USA Minimum Volatility Factor ETF (USMV) is up 2.7% year to date. By contrast, the US stock market overall (SPY) is down 8.0%. All the other factor ETFs are also in the red so far this year.

The deepest factor loss in 2025: small-cap value stocks, which have crashed 18.9%, based on iShares S&P Small-Cap 600 Value ETF (IJS).

Although most slices of the US equity market have taken a hit this year, small-cap value’s fall from grace has been unusually harsh. Perhaps the reversal of fortunes is related to IJR’s previously high-flying performance.

Consider the perspective of investing equal dollar amounts five years ago in small-cap value (IJR), low vol (USMV) and the broad equity market (SPY). As recently as early December 2024, small-cap value was outperforming both funds over that time frame.

In recent months, however, the tables turned quickly and dramatically this year for IJR, although it’s still outperforming low vol (USMV) over the trailing 5-year window.

All of which reminds that cycles dominate equity factors. With that in mind, the hefty haircut for small-cap value of late may be laying the foundation for another bull run for these stocks. Timing, as always, is uncertain. Meanwhile, value/contrarian-oriented investors may do well by looking for signs of a bottom in IJR, perhaps at some point in the near future.

Author: James Picerno