Macro Briefing: 1 November 2024

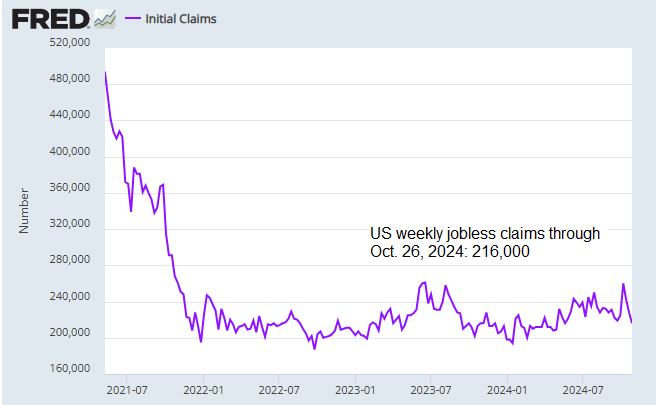

US jobless claims fell to a five-month low last week… “We continue to expect the Fed to ease policy by 25bps at every meeting through June next year amid resilient but moderating growth and cooling labor market trends,” writes EY Chief Economist Gregory Daco… US federal debt is a rising risk…

US jobless claims fell to a five-month low last week. The decline marks the third straight week of lower filings for unemployment benefits and appears to be another round of fading distortions from hurricanes that struck the Southeast US in September.

The Fed’s preferred inflation measure eased to 2.1% in year-over-year terms through September, slightly above the central bank’s inflation target. The data persuades some economists that another rate cut is likely at the upcoming Nov. 7 FOMC meeting. “We continue to expect the Fed to ease policy by 25bps at every meeting through June next year amid resilient but moderating growth and cooling labor market trends,” writes EY Chief Economist Gregory Daco.

US consumer spending rose more than expected in September, based on personal consumption expenditures (PCE) data. PCE rose 0.5% last month after an upwardly revised 0.3% gain in August. The monthly advance translates into a relatively steady year-over-year trend of 5%-plus, which suggests that the consumer sector’s recent strength will prevail for the near term.

US oil production rose 1.5% in August to a monthly record high of 13.4 million barrels per day, the U.S. Energy Information Administration reports. The latest rise exceeds the prior record high of 13.31 million bpd in December 2023.

US federal debt is a rising risk factor for the US Treasury market, advises TMC Research. The analysis cites several clues that suggest the increase in the US debt-to-GDP ratio and interest payments as a percent of GDP in recent years is casting a bigger influence over the bond market.

Author: James Picerno