Macro Briefing: 10 December 2024

US Treasury yield curve is close to un-inverting after more than two years of long rates trading below short rates…”US gasoline prices fell to the lowest level since 2021… The average national gasoline price was $2… A runup in the production of crude oil, a key factor influencing gas pri…

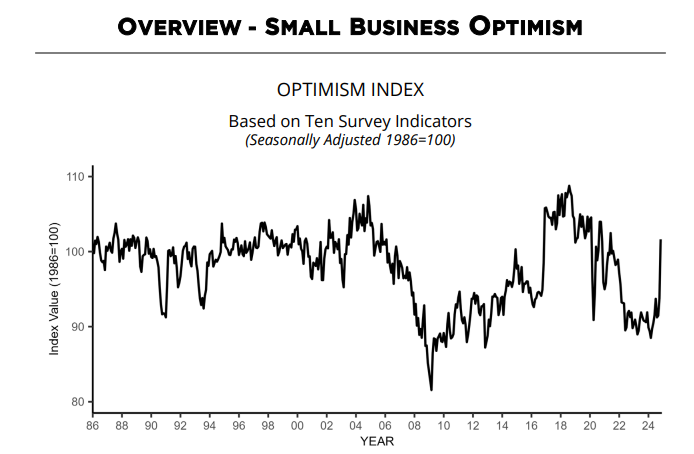

US small business optimism rose sharply in November, according to NFIB’s survey. “The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners,” says NFIB chief economist Bill Dunkelberg. “Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty.”

US gasoline prices fell to the lowest level since 2021. The average national gasoline price was $2.97 per gallon on Monday. A runup in the production of crude oil, a key factor influencing gas prices, is considered the primary driver of the price slide.

China’s exports in November rose 6.7% in US dollar terms from year ago, sharply lower than the 12.7% growth in the previous month. The news fueled concerns over the health of the Chinese economy at a time when consumer demand remains sluggish and a new tariff threats lurk with the incoming Trump administration in Washington.

Will a trade war trigger rate cuts in Europe? Bond giant Pimco says that’s a plausible scenario related to fallout from a possible wave of new tariffs from the incoming Trump administration. “I imagine you could easily price in lower terminal rates, in the event of worse-than-expected outcomes where the ECB is going to more emergency levels of policy rates,” says Andrew Balls, chief investment officer for global fixed income manager.

Google reveals quantum computing chip with ‘breakthrough’ achievements. The so-called Willow chip is capable of complex computations massively faster relative to current supercomputers.

US Treasury yield curve is close to un-inverting after more than two years of long rates trading below short rates. The current spread for 10-year less 3-month maturities is -0.20 basis points.

Author: James Picerno