Macro Briefing: 10 October 2024

“The stock market is reaching new heights even as assets in money market mutual funds rose to a record $6…62 billion) swap facility to aid the stock market… “The swap facility is designed to provide liquidity support to non-bank financial institutions, and can help lift confidence in the st…

More than 3 million residents are without power in Florida as Hurricane Milton moves across the state, leaving a path of destruction. The storm is expected to move off the state’s East Coast into the Atlantic Ocean later today.

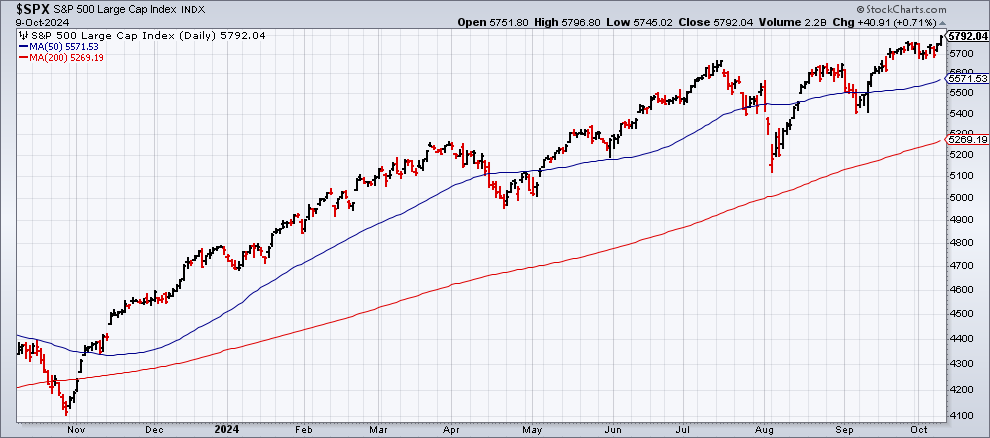

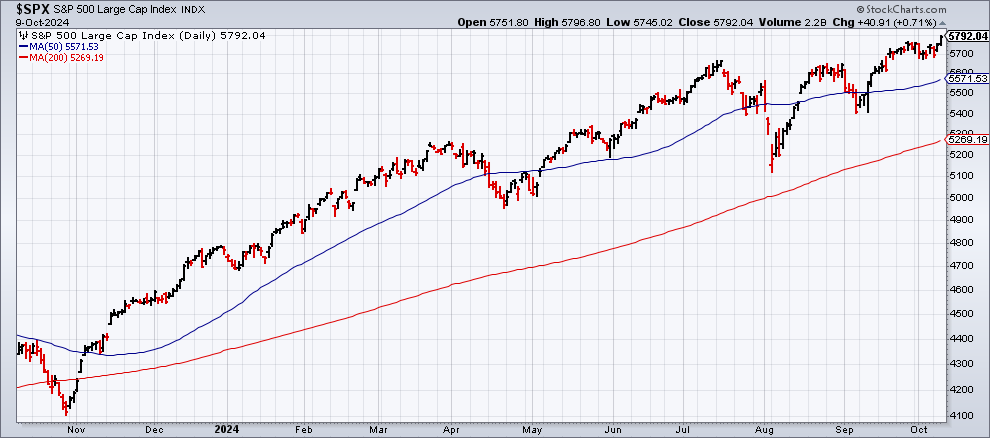

US stocks rallied to a new record high on Wednesday, based on the S&P 500 Index. “The stock market is reaching new heights even as assets in money market mutual funds rose to a record $6.5 trillion during the October 2 week,” observe analysts at Yardeni.com. “That’s quite remarkable. Imagine the meltup in stock prices if the Fed continues to lower interest rates.”

Fed officials disagreed on how much to cut rates last month, according to minutes of the FOMC meeting. “Some participants observed that they would have preferred a 25 basis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision,” the minutes stated. The actual cut was 50 basis points at last month’s policy meeting.

China’s central bank today announced a new 500 billion yuan ($70.62 billion) swap facility to aid the stock market. “The swap facility is designed to provide liquidity support to non-bank financial institutions, and can help lift confidence in the stock market,” says Ming Ming, analyst at Citic Securities.

Germany’s economy is expected to shrink for a second year in 2024, based on a new government forecast. AP reports: “Vice Chancellor Robert Habeck, who is also the economy minister, said that the German economy hasn’t seen powerful growth since 2018 as the country’s structural problems have been joined by wider global challenges.”

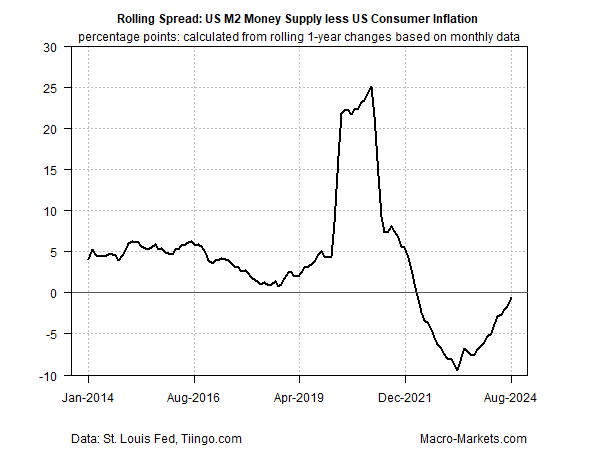

A broad measure of the US money supply trend looks set to switch to an inflation bias for the first time in 2 years, advises a research note from TMC Research: “The spread continues to narrow between the year-over-year changes in a broad measure of US money supply (M2) less US consumer inflation. As this gap narrows – and if it soon turns positive, which looks likely – the implied forecast is that monetary policy’s disinflationary bias of the last several years will shift to an inflationary posture, albeit mildly so.”

Author: James Picerno