Macro Briefing: 10 September 2025

The annual revision shows that the jobs market had been growing at a slower pace than previously estimated… “The slower job creation implies income growth was also on a softer footing even prior to the recent rise in policy uncertainty and economic slowdown we’ve seen since the spring,” sai…

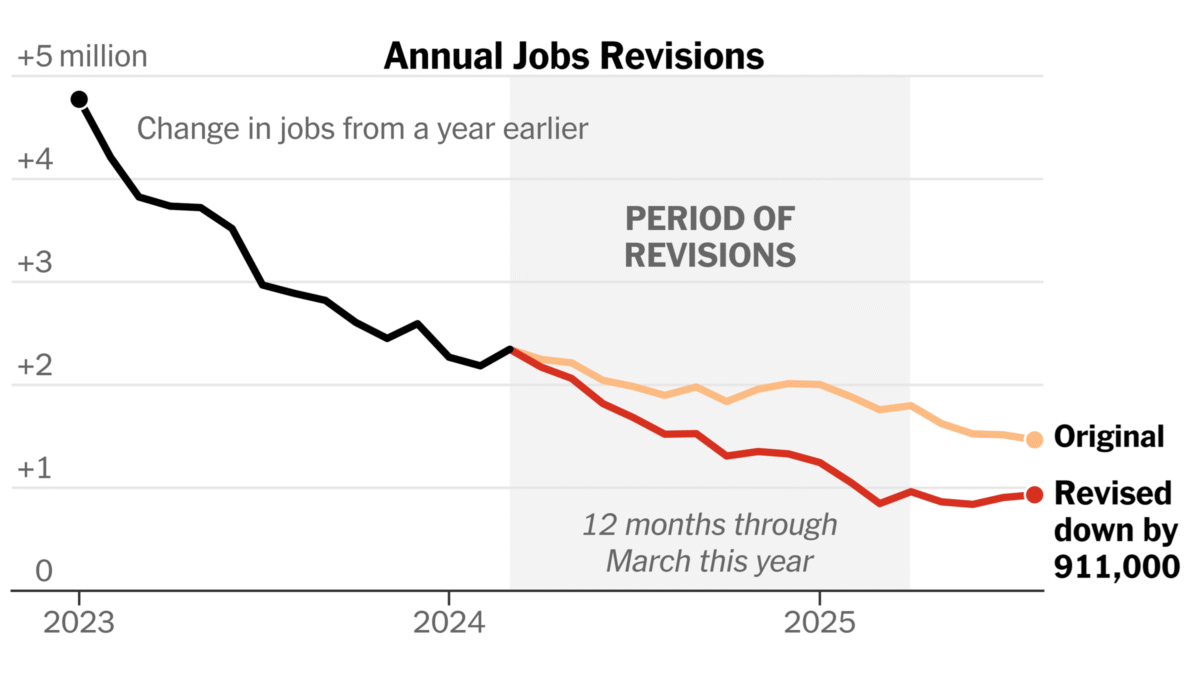

US employers added 911,000 fewer jobs during the 12 months through March, according to preliminary data from the Labor Department. The annual revision shows that the jobs market had been growing at a slower pace than previously estimated. “The slower job creation implies income growth was also on a softer footing even prior to the recent rise in policy uncertainty and economic slowdown we’ve seen since the spring,” said Oren Klachkin, market economist at Nationwide Financial. “This should give the Fed more impetus to restart its cutting cycle.”

A Federal judge blocked President Donald Trump from firing Federal Reserve Governor Lisa Cook. “The public interest in Federal Reserve independence weighs in favor of Cook’s reinstatement,” US District Court Judge Jia Cobb wrote in granting Cook a preliminary injunction barring her termination.

Wall Street forecasters are raising forecasts for the S&P 500 Index amid robust corporate earnings reports and enthusiasm for artificial intelligence-fueled spending. “There is froth, but as long as AI capex remains intact, the bull market should continue,” said Wells Fargo’s Ohsung Kwon, the firm’s top equity strategist .

Deflation returned to China’s economy in August, according to the official consumer price index, which dropped 0.4% on the year. China’s producer prices index fell even more, sliding 2.9% year on year.

The Federal Reserve is expected to cut interest rates next week even despite inflation still running around 3%, a full percentage point above the Fed’s 2% target. Reuters reports: “The last time before this cycle that the central bank eased policy with core PCE inflation at 3%, you have to go all the way back to the early 1990s, before the Fed unofficially adopted its 2% target.”

Author: James Picerno