Macro Briefing: 11 April 2024

Larry Summers says Fed may raise interest rates * Has the business cycle been tamed? Some analysts are cautiously optimistic * Rising oil prices could soon approach $100/bbl, BoA analyst predicts * China’s consumer price inflation slowed more than expected in March * US headline consumer inflatio…

* Investors adapt to a year that may witness no rate cuts

* Former Treasury Sec. Larry Summers says Fed may raise interest rates

* Has the business cycle been tamed? Some analysts are cautiously optimistic

* Rising oil prices could soon approach $100/bbl, BoA analyst predicts

* China’s consumer price inflation slowed more than expected in March

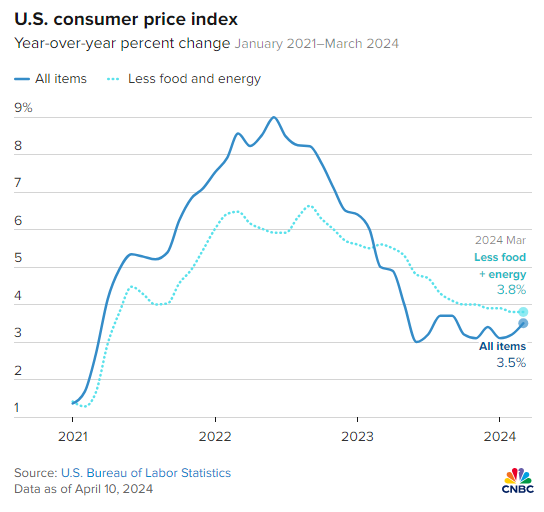

* US headline consumer inflation rises more than expected in March:

The US dollar rose to a 5-month high on Wednesday (Apr. 10) as US consumer inflation posted a higher-than-expected increase in March. Helping drive the world’s reserve currency against other currencies: firmer prospects that US interest rates cuts will be delayed, with the possibility that the Fed may be persuaded that yet another hike is needed to tame inflation. In turn, the US dollar becomes more attractive on a relative basis and government bonds offer higher yields.

Author: James Picerno