Macro Briefing: 11 December 2024

US economic activity still appears on track to post a softer increase in the fourth quarter, but the downshift remains gradual and so recession risk is low, according to an update of TMC Research’s GDP nowcasting model… Microsoft shareholders reject idea for company to buy bitcoin… Billionair…

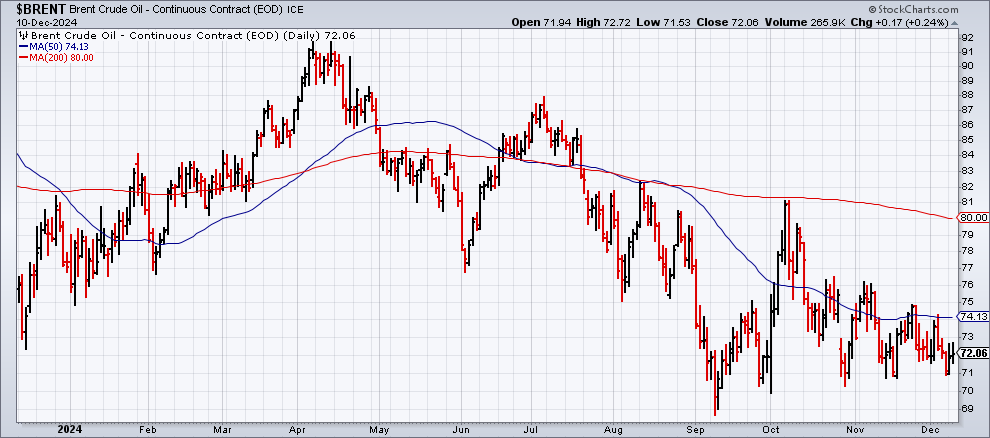

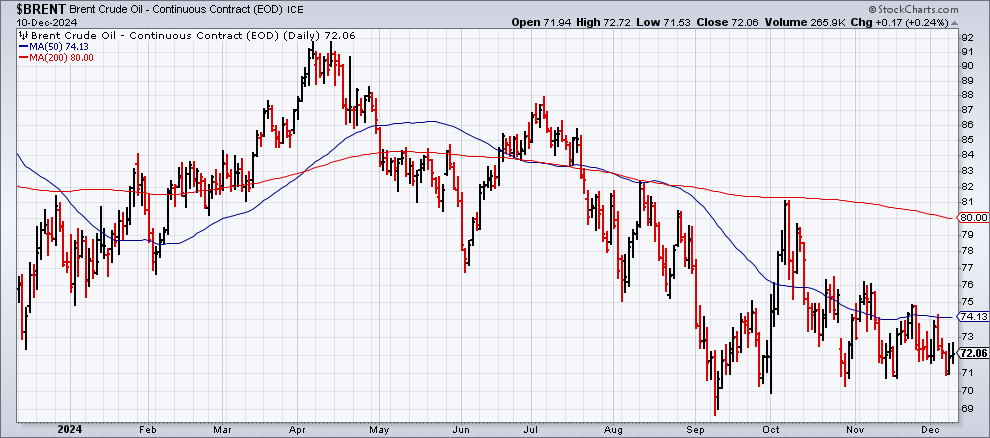

Saudi Arabia is struggling with its plan to keep crude oil prices elevated. “Rising US production and internal OPEC+ pressure limit the kingdom’s sway over prices,” reports The Wall Street Journal. Trump is a new source of uncertainty as US-based shale drillers may be embolded to lift output amid a push for deregulation. Meanwhile, the International Energy Agency estimates global supply will exceed demand by more than one million barrels a day next year without a production cut. Brent, the international oil benchmark, is down 6.5% this year.

Shares of major insurance firms have fallen 6% since last week’s murder of Brian Thompson, CEO of UnitedHealth Group, which triggered public debate about the business policies of the industry. “I think the response investors have had is, ‘do we want to own this category of stocks if there’s going to be this now renewed negative focus on the industry?’”, says Jared Holz, Mizuho’s health-care equity strategist.

Drugstore chain Walgreens may go private in a deal to sell itself to private equity firm Sycamore Partners. Shares of Walgree rose 20% on Tuesday amid a report that a deal could completed in early 2025.

Microsoft shareholders reject idea for company to buy bitcoin. Billionaire bitcoin investor Michael Saylor, executive chairman of MicroStrategy, said during Microsoft’s shareholder meeting that the software company could convert cash flows, dividends, buybacks and debt into bitcoin. Microsoft investors voted down the proposal.

US economic activity still appears on track to post a softer increase in the fourth quarter, but the downshift remains gradual and so recession risk is low, according to an update of TMC Research’s GDP nowcasting model. The revised estimate indicates a 2.5% annualized increase in output for the October-through-December quarter, modestly down from a solid 2.8% in Q3.

Author: James Picerno