Macro Briefing: 11 June 2024

2% in May* EU expected to impose tariffs on Chinese electric vehicles* Oil companies are reporting record profits* US small business sentiment index ticks up but remains near multi-year low:The stock market is a useful indicator for evaluating recession risk, but it should be viewed caut…

* Fed appears set to leave interest rates unchanged tomorrow

* Three Democratic senators urge Fed to cut rates at this week’s FOMC meeting

* Median inflation expectations for 1-year horizon tick down to 3.2% in May

* EU expected to impose tariffs on Chinese electric vehicles

* Oil companies are reporting record profits

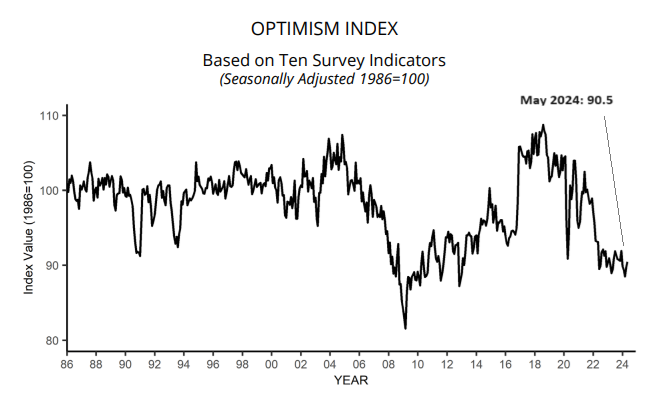

* US small business sentiment index ticks up but remains near multi-year low:

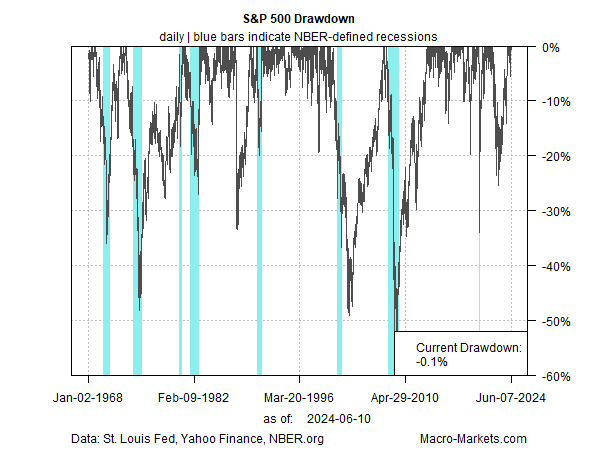

The stock market is a useful indicator for evaluating recession risk, but it should be viewed cautiously and used in context with other metrics, advises a new research note from TMC Research, a division of The Milwaukee Company, a wealth management firm. “The key lesson here is not that the stock market is useless for building models to nowcast recession risk. Au contraire –- it’s valuable, perhaps more so than any one indicator. But a ‘trust but verify’ approach is advisable. Using the equities market alone, and assuming it’s flawless for anticipating the next recession, is assuming too much.”

Author: James Picerno