Macro Briefing: 11 March 2024

* Strong US growth prompts investors to buy a broader set of stocks * China’s housing minister: troubled real-estate developers should go bankrupt * China consumer inflation rises for first time in six months * Japan avoids technical recession after Q4 economic data revised up * Bank of Japan expe…

* Strong US growth prompts investors to buy a broader set of stocks

* China’s housing minister: troubled real-estate developers should go bankrupt

* China consumer inflation rises for first time in six months

* Japan avoids technical recession after Q4 economic data revised up

* Bank of Japan expected to scrap world’s last negative interest rate experiment

* Gold prices steady on Monday after hitting record highs last week

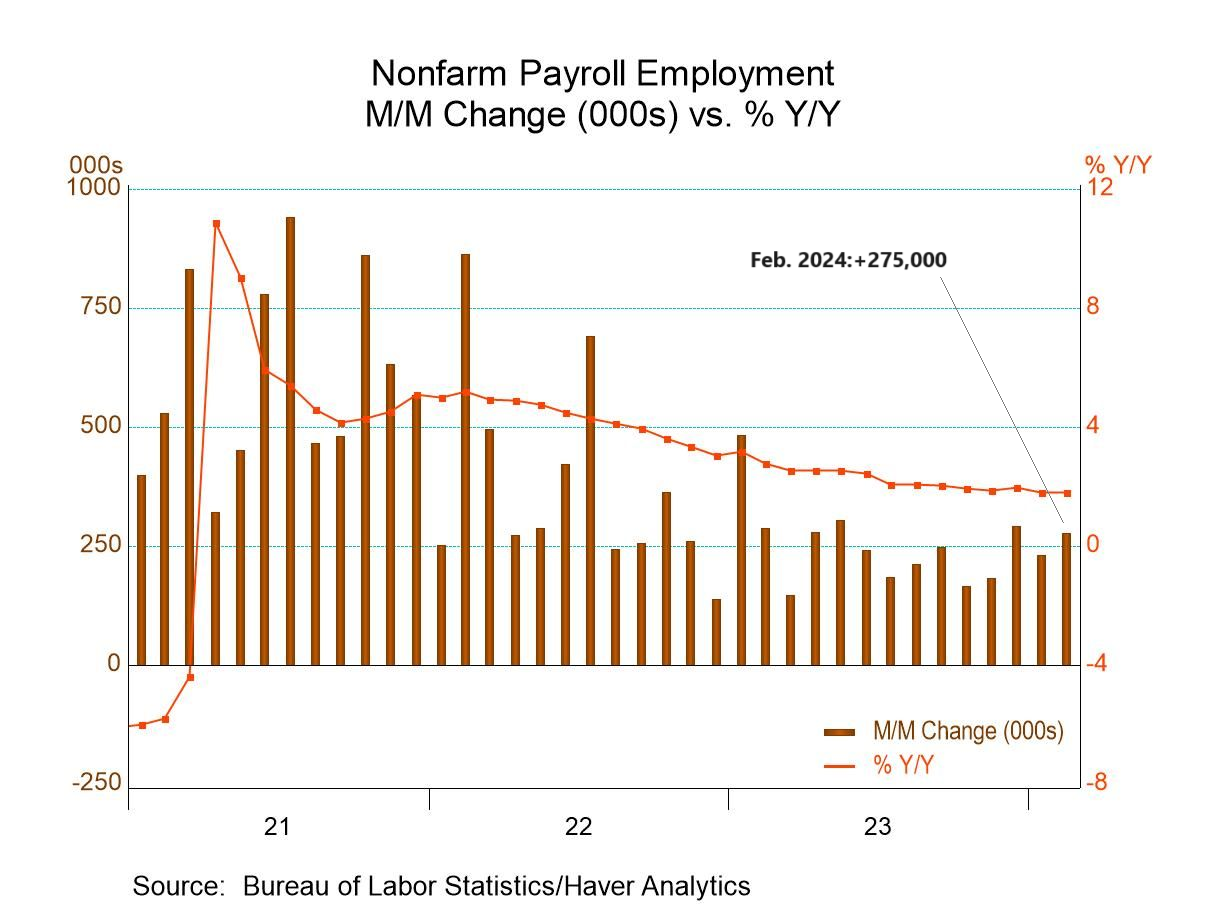

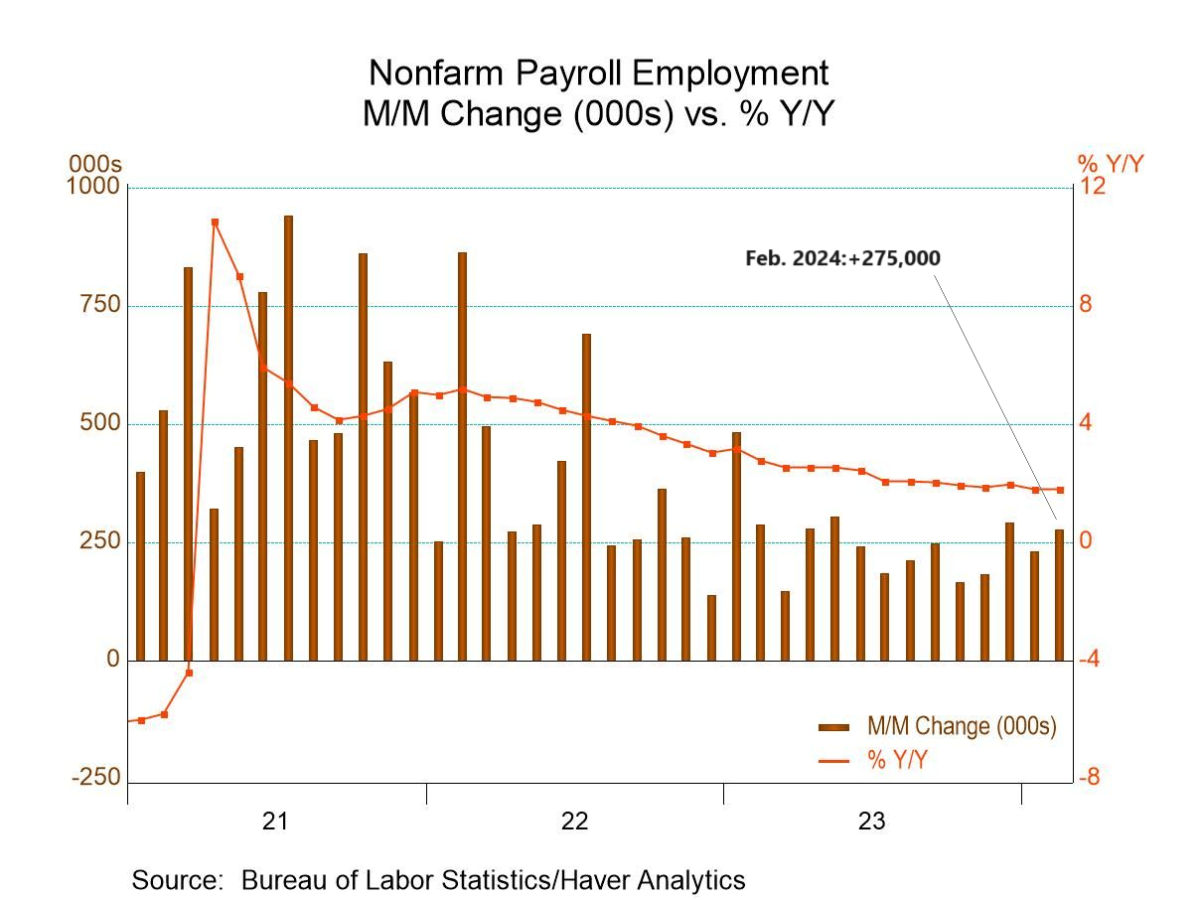

* US nonfarm payrolls increase 275,000 in February, beating expectations:

Barclays turns bearish on US Treasuries after ‘excessive’ bond rally. “Incoming data suggests that the US economy remains resilient with the labor market generating solid real income growth while simultaneously rebalancing for now,” strategists at the firm write. “The rally over the last few weeks seems excessive and we recommend shorting 10-year US Treasuries.” Meanwhile, the 10-year yield on Friday closed at 4.09%, its lowest close in a month:

Author: James Picerno