Macro Briefing: 12 March 2024

TutoSartup excerpt from this article:

* US is world’s largest oil producer, again–leading output for sixth straight year * JPMorgan CEO Jamie Dimon urges Fed to delay rate cuts * Haiti’s prime minister resigns amid increasing violence * Will China’s surging exports trigger a backlash in the West? * US Small Business Optimism Ind…

Macro Briefing: 12 March 2024

Author: James Picerno

* US is world’s largest oil producer, again–leading output for sixth straight year * JPMorgan CEO Jamie Dimon urges Fed to delay rate cuts * Haiti’s prime minister resigns amid increasing violence * Will China’s surging exports trigger a backlash in the West? * US Small Business Optimism Ind…

* US is world’s largest oil producer, again–leading output for sixth straight year

* JPMorgan CEO Jamie Dimon urges Fed to delay rate cuts

* Haiti’s prime minister resigns amid increasing violence

* Will China’s surging exports trigger a backlash in the West?

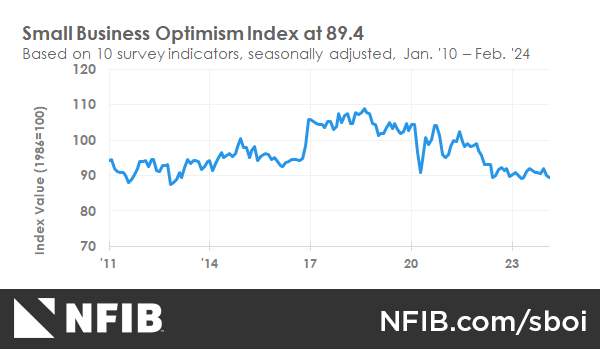

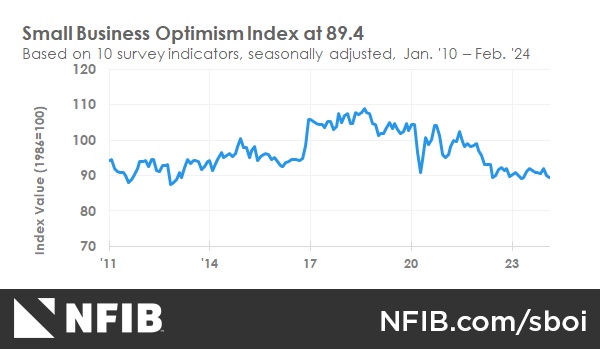

* US Small Business Optimism Index ticks down to 10-month low in February:

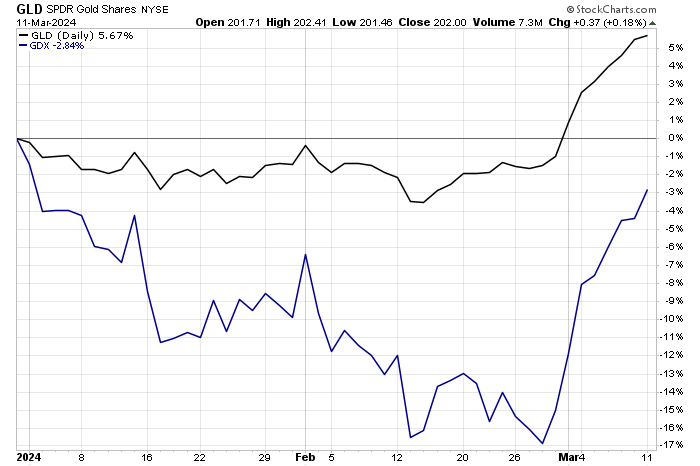

Gold has surged in 2024, but gold mining stocks are still playing catch-up relative to the precious metal. SPDR Gold Shares (GLD), an ETF that holds gold bullion, is up 5.7% year to date through Monday’s close (Mar. 11). Meanwhile, VanEck Gold Miners ETF (GDX), a portfolio of gold mining shares, is down 2.8% so far in 2024.

Author: James Picerno