Macro Briefing: 13 August 2025

President Trump’s nomination to head the Bureau of Labor Statistics triggered criticism from economists across the political spectrum, Axios reports… Trump tells Goldman Sachs that it should replace bank’s economist over tariff predictions… Trump did not name the economist he wants as a r…

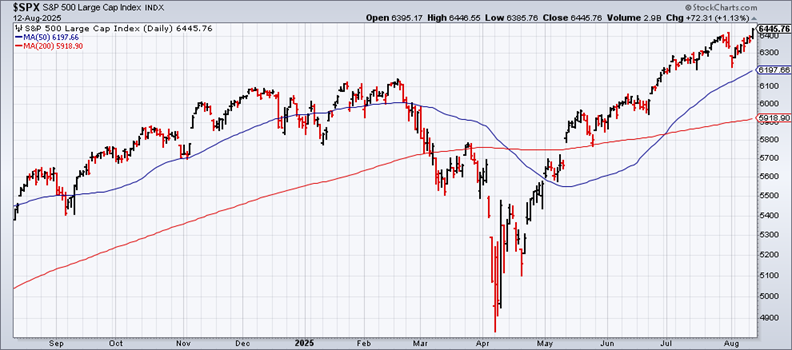

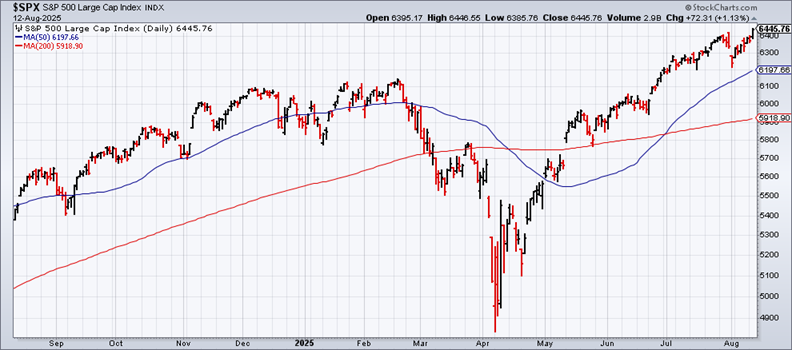

US stock market closes at another record high. The S&P 500 Index on Tuesday rallied 1.1%, marking a new all-time peak.

President Trump’s nomination to head the Bureau of Labor Statistics triggered criticism from economists across the political spectrum, Axios reports. Antoni’s “work at Heritage has frequently included elementary errors or nonsensical choices that all bias his findings in the same partisan direction,” said Stan Veuger, a senior fellow at the conservative American Enterprise Institute.

The US government’s gross national debt has topped $37 trillion, a record amount, the Treasury Department reports. The increase marks a faster rise by several years to $37 trillion compared with pre-pandemic projections by the The Congressional Budget Office.

Artificial intelligence start-up Perplexity AI made a surprise bid for Google Chrome, the world’s most popular web browser. The three-year-old firm is headed by a former Google and OpenAI employee.

Trump tells Goldman Sachs that it should replace bank’s economist over tariff predictions. Trump did not name the economist he wants as a replacement.

US consumer inflation rose 2.7% in July vs. the year-ago level, slightly less than expected. The headline increase indicated a mostly modest impact from tariffs so far. The core reading of inflation, considered a more reliable measure of the trend, edged up to a 3.0% annual pace, the highest since February. “Inflation is on the rise, but it didn’t increase as much as some people feared,” said Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management. “In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table. Longer term, we likely haven’t seen the end of rising prices as tariffs continue to work their way through the economy.”

Author: James Picerno