Macro Briefing: 14 April 2025

The flight-to-safety trade, which usually benefits Treasuries and the US dollar, was conspicously absent in recent days…Mixed signals from Trump administration continue to sow confusion for tariff and trade outlook… China’s exports surged in March as trade war as businesses frontloaded pur…

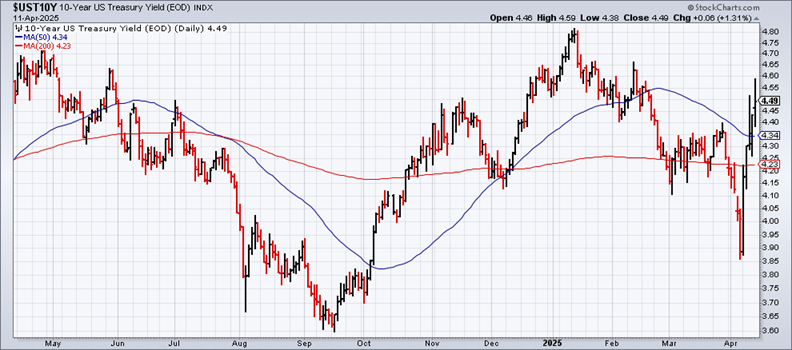

The US Treasury market will be closely watched this week as investors consider if the risk premium for the world’s “safe asset” is in the process of resetting high. A possible warning sign: the 10-year yield rose sharply last week despite growing concerns that US economic growth is slowing. The flight-to-safety trade, which usually benefits Treasuries and the US dollar, was conspicously absent in recent days. “The market is re-assessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization. Nowhere is this more evident than the continued and combined collapse in the currency and US bond market as this week comes to a close,” Deutsche Bank strategist George Saravelos wrote in a note to clients Friday.

Mixed signals from Trump administration continue to sow confusion for tariff and trade outlook. “The turmoil of this tariff roller coaster is going to continue to have negative effects,” said Adam Thierer, a senior fellow at the R Street Institute think tank focused on technology and innovation.

China’s exports surged in March as trade war as businesses frontloaded purchases to minimize effects of trade war. Exports jumped 12.4% last month in US dollar terms from a year earlier, far ahead of expectations.

The US Consumer Sentiment Index fell for a fourth straight month in April. “This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation,” notes the University of Michigan’s Surveys of Consumers Director. “Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year.”

Author: James Picerno