Macro Briefing: 14 August 2024

* US regulator considers breaking up Google * The unraveling of “carry trades” isn’t over, strategists predict * US consumers fell behind on debt payments as pandemic-era wealth fades * World’s largest sovereign wealth fund reports robust 1H tech-driven profits * Home Depot downgrades earnin…

* US regulator considers breaking up Google

* The unraveling of “carry trades” isn’t over, strategists predict

* US consumers fell behind on debt payments as pandemic-era wealth fades

* World’s largest sovereign wealth fund reports robust 1H tech-driven profits

* Home Depot downgrades earnings outlook as consumers turn cautious

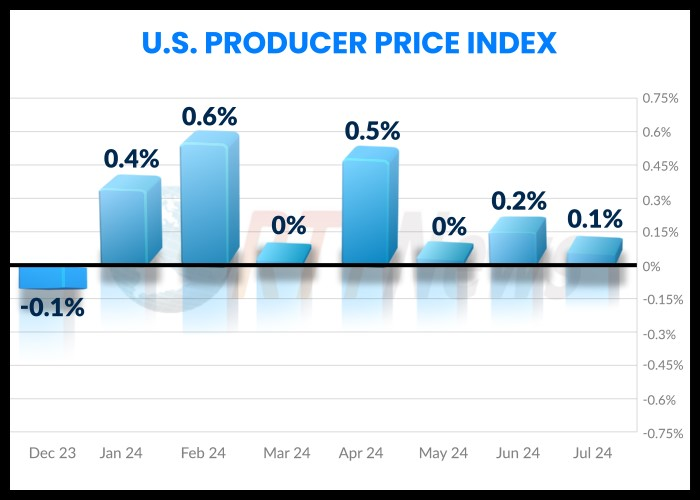

* US wholesale inflation’s monthly changed ticked lower in July:

Can forecasts from economists help investors sidestep recession risk vis-a-vis investing the stock market? History doesn’t look encouraging on that front, notes Morningstar’s John Rekenthaler. “Predictions from economists about potential GDP declines would not have helped equity shareholders, had they integrated such information into their decisions,” he reports. “In most cases, stock prices beat the forecasters to the bad news, meaning that investors who used such predictions to change their asset allocations were, to use my father’s words, a day late and a dollar short.”

Author: James Picerno