Macro Briefing: 14 January 2025

“TMC Research’s Fed funds model indicates that the current 4…The US 10-year Treasury yield continues rising, trading at 4…0 percent at the one-year-ahead horizon, increased to 3…6 percent at the three-year-ahead horizon, and declined to 2…9 percent at the five-year-ahead horizon…0 per…

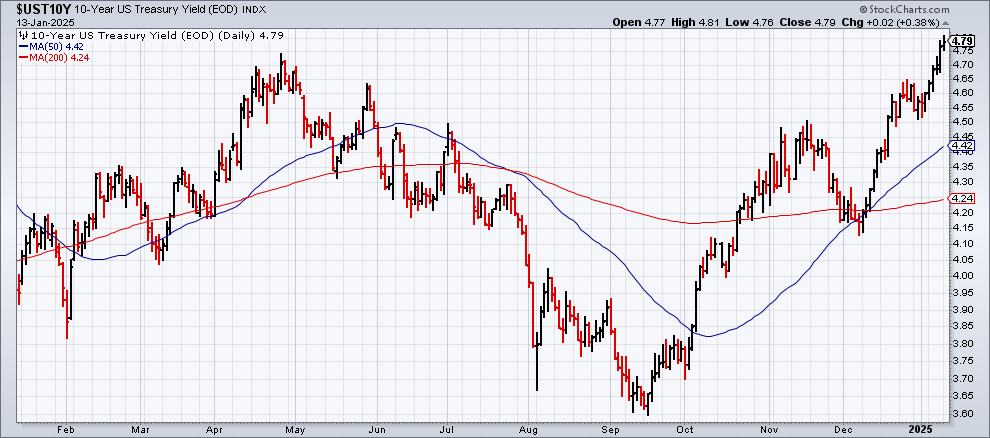

The US 10-year Treasury yield continues rising, trading at 4.79% on Monday, the highest since early November 2023. “Bond investors are sending a clarion call to the world’s fiscal authorities to get a grip on their budget trajectories, lest they be subjected to additional wrath,” says Tony Crescenzi, an executive vice president at Pimco.

The incoming Trump administration looks set to take charge of a robust US economy. “Success for the Trump administration would be to do no harm to the exceptionally performing economy it is inheriting,” says Mark Zandi, chief economist at Moody’s Analytics. He advises that plans for new tariffs, deportations, and deficit-funded tax cuts “will do harm. How much … depends on how aggressively these policies are pursued.”

US consumers’ outlook for inflation was mixed in December, according to New York Fed survey. The regional Fed bank reports: “Median inflation expectations were unchanged at 3.0 percent at the one-year-ahead horizon, increased to 3.0 percent from 2.6 percent at the three-year-ahead horizon, and declined to 2.7 percent from 2.9 percent at the five-year-ahead horizon.”

Small business optimism rose for a second month in December. “Optimism on Main Street continues to grow with the improved economic outlook following the election,” says the chief economist at the National Federation of Independent Business.

US tightens restrictions on AI chips exports. The new rules set caps for exports of certain technology to most countries and require US companies to file for approval for those markets.

Fed rate cuts are expected to be on pause for the near term, advises a research note from TMC Research, a division of The Milwaukee Company, a wealth manager. “TMC Research’s Fed funds model indicates that the current 4.25%-to-4.50% range for the target rate is moderately tight, which suggests there’s room to ease. But there’s uncertainty about expected policy changes favored by the incoming Trump administration – changes that may be inflationary to a degree, according to some forecasters.”

Author: James Picerno