Macro Briefing: 14 March 2025

US stock market falls into correction territory… US jobless claims eased last week, remaining low and signaling a still-healthy labor market… It just adds to unpredictability and uncertainty, and that’s a negative for stocks, obviously,” said Jed Ellerbroek, portfolio manager at Argent Capit…

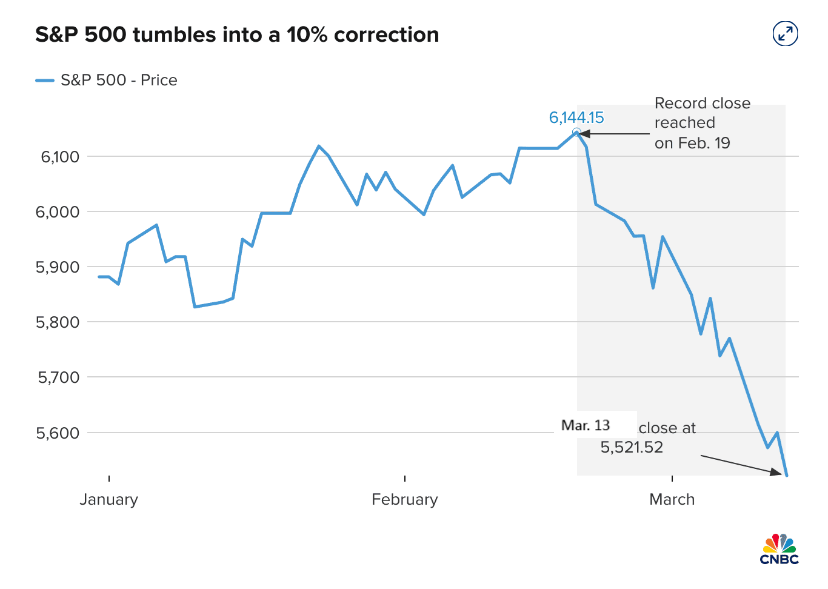

US stock market falls into correction territory. The S&P 500 Index closed yesterday (Mar. 13) with a 10.1% decline from its previous peak, which was a record high. “These tariff wars are intensifying before they’re abating. It just adds to unpredictability and uncertainty, and that’s a negative for stocks, obviously,” said Jed Ellerbroek, portfolio manager at Argent Capital Management.

Senate Democratic leader Chuck Schumer says he’ll back GOP spending bill to avert a government shutdown. Presumably there will be enough Democrats in the Senate to vote for the bill, although that’s not a certainty. Unless the legislation is approved today, and signed by President Trump, a government shutdown begins at midnight.

US jobless claims eased last week, remaining low and signaling a still-healthy labor market. New claims filings fell by 2,000 to 220,000 for the week ending March 8, the Labor Department reports. A source of uncertainty in the weeks ahead is when job cuts ordered by the Department of Government Efficiency will start showing up in the weekly layoffs report.

Gold rises to a new record high at $2,991 an ounce on Thursday (Mar. 13). “President Trump’s rapid move to announce, if not always to enact, import tariffs has contributed to geopolitical uncertainty and boosted inflation expectations, helping push down front-end real rates and supporting gold in the face of periodic USD strength and initially reduced expectations for Fed rate cuts,” Marcus Garvey, head of commodities strategy at Macquarie, wrote on Thursday.

Some business leaders remain optimistic on the outlook for the economy vis-a-vis Trump 2.0 policies. Blackstone CEO Steve Schwarzman this week predicted that US tariffs will lift US-based manufacturing and “given the size of the US, that tends to be a good thing for the world.” Goldman Sachs CEO David Solomon also offered upbeat comments this week: “The level of uncertainty is a little bit higher, and that has kept some possible transactions on the sidelines, but the overall level of dialogue, as people are thinking strategically about where they want to drive their businesses, is certainly increasing.”

Correlations among global assets have fallen to the lowest level in over two years, according to analysis by TMC Research, a unit of The Milwaukee Company, a wealth manager. “The dramatic pullback suggests that a new regime of relatively low-to-moderate correlations may be dawning,” TMC wrote in a note on Thursday. “If so, the downshift opens the door for enhanced opportunities for designing and managing globally diversified portfolios.”

Author: James Picerno