Macro Briefing: 14 October 2024

“Despite strong labor markets, high prices and inflation remain at the top of consumers’ minds,” notes Joanne Hsu, director of the University of Michigan’s Consumer Sentiment survey, in a statement… While inflation expectations have eased substantially since then, consumers continue to ex…

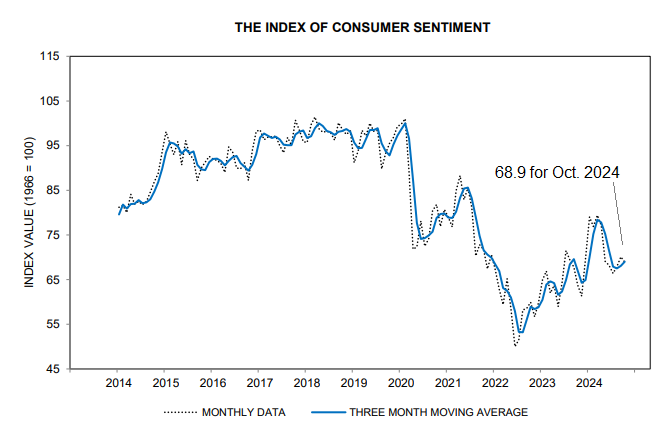

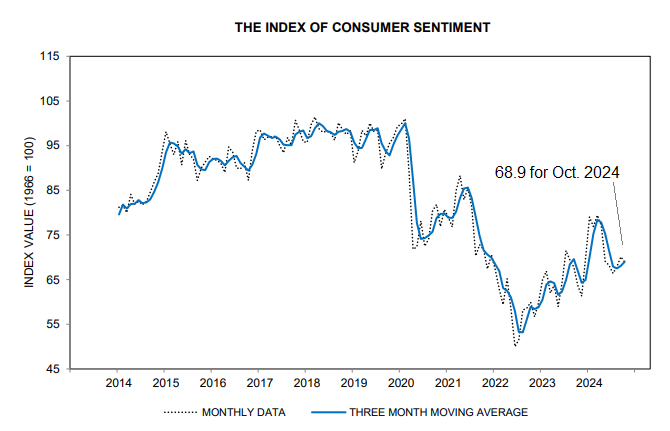

High cost of living weighs on US consumer sentiment in October. “Despite strong labor markets, high prices and inflation remain at the top of consumers’ minds,” notes Joanne Hsu, director of the University of Michigan’s Consumer Sentiment survey, in a statement. “Sentiment is currently 8% stronger than a year ago and almost 40% above the trough reached in June 2022. While inflation expectations have eased substantially since then, consumers continue to express frustration over high prices.”

JP Morgan says the US has achieved a soft economic landing — lower inflation and a growing economy. “These results are consistent with a soft landing,” the bank’s chief financial officer Jeremy Barnum said on a conference call. “That’s pretty consistent with this kind of Goldilocks economic situation.”

Chinese finance minister suggests Beijing will increase the country’s debt and the deficit to stimulate the slowing economy. Meanwhile, Goldman Sachs lifted its forecast for China’s economic forecast for 2024 to 4.9% from 4.7% for 2024, citing the government’s latest round of stimulus measures. But in a sign of ongoing headwinds, deflation in China deepened in September: producer prices index fell 2.8% over the previous year, down from a 1.8% decline in August.

Boeing will cut 17,000 jobs, or 10% of its workforce, amid mounting losses for the company. The announcement coincides with a strike by its machinists now in it fifth week.

Cleveland Fed’s inflation forecasting model suggests the Fed’s 2% target has been achieved, based on the estimate for the upcoming September report on the price index via personal consumption expenditures data. The model projects a 2.06% year-over-year rise in PCE through last month. Goldman Sachs is forecasting a similar increase for September: 2.04%.

Author: James Picerno