Macro Briefing: 15 December 2025

White House economic adviser Kevin Hassett, the front-runner to be the Federal Reserve’s next chair, said there is “plenty of room” to cut interest rates further… “The contraction of fixed asset investment and the drop in property prices in recent months have been transmitted to the consu…

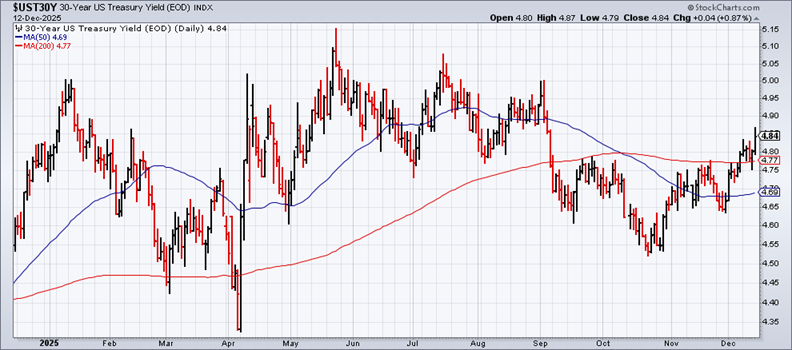

US 30-year Treasury yield starts the trading week at its highest level in more than three months. The long-bond rate, the most inflation-sensitive maturity, closed up on Friday at 4.84%, the highest since early September.

Two delayed US economic reports scheduled this week will provide more context on macro conditions. November updates are set for payrolls (Tues., Dec. 16) and inflation (Thurs., Dec. 18), offering an enhanced review on the economic trend following a government shutdow that postponed regular data releases.

White House economic adviser Kevin Hassett, the front-runner to be the Federal Reserve’s next chair, said there is “plenty of room” to cut interest rates further. He noted that he could change his mind if inflation rises.

China’s economic slowdown deepened in November as consumption, investment and industrial output growth fell short of expectations. “The contraction of fixed asset investment and the drop in property prices in recent months have been transmitted to the consumer sentiment,” Zhiwei Zhang, president and chief economist at Pinpoint asset management, said in a note.

Author: James Picerno