Macro Briefing: 15 October 2024

Referring to recent economic reports, he advises that “the data is signaling that the economy may not be slowing as much as desired… While we do not want to overreact to this data or look through it, I view the totality of the data as saying monetary policy should proceed with more caution on t…

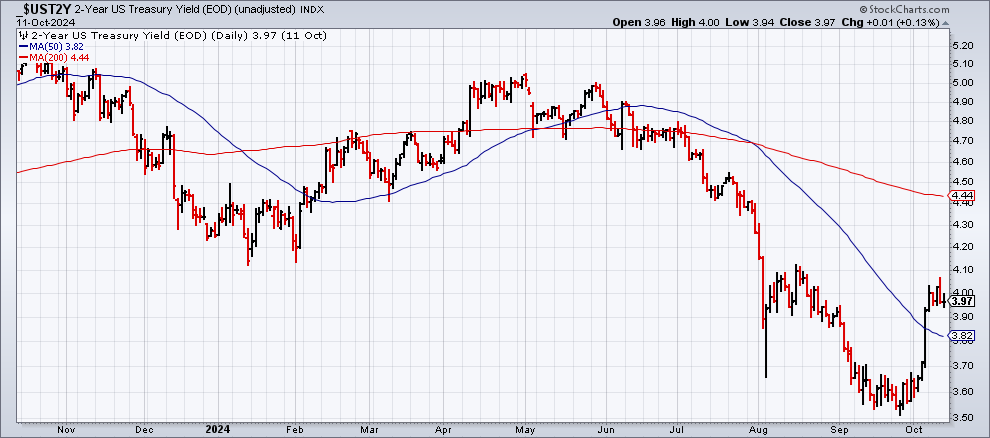

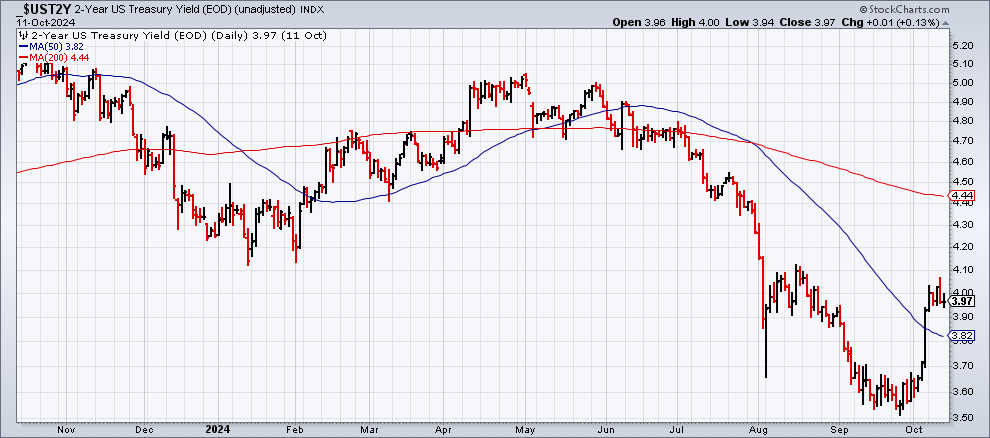

Interest rate cuts going forward will be less aggressive, says Federal Reserve Governor Christopher Waller. Referring to recent economic reports, he advises that “the data is signaling that the economy may not be slowing as much as desired… While we do not want to overreact to this data or look through it, I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting.” Meanwhile, the policy-sensitive US 2-year Treasury yield continues to trade around the 4% mark:

Will geopolitical risk derail the bull run for US stocks? That’s a possibility, but the market continues to downplay the shock potential. One line of reasoning is that favorable US economic conditions are persuading investors to look through Middle East risk and the upcoming presidential election. “One key point with geopolitical shocks, as well as elections, is that the economic context has eventually always dominated,” advise analysts at Deutsche Bank. Bob Elliott, chief investment officer at fund manager Unlimited, notes that the US economy is in “a pretty unusual circumstance globally.” He says that despite growth and low unemployment, “we are [still] getting easing” with monetary policy. “It’s not a normal cycle,” concludes Kristina Hooper, chief market strategist at Invesco.

Global Public Debt is expected to exceed $100 trillion, predicts the IMF. That’s roughly 93% of global gross domestic product for the end of 2024 and “will approach 100 % of GDP by 2030. This is 10 percentage points of GDP above 2019, that is, before the pandemic.”

Interest rates “will probably be higher than they were in the years before the pandemic,” writes Richard Clarida, former vice-chair of the Federal Reserve and global economic adviser at Pimco. “I believe most of the required adjustment will occur through the slope of the yield curve and not so much from a much higher destination for the fed funds rate itself. If the view is correct, it augurs well for fixed income investors. They will be rewarded for bearing interest rate risk in good times and will also benefit from the hedging value of bonds in their portfolio when the economy weakens. Rates will then have more room to fall and thus for bond prices to rise.”

China’s exports slowed sharply in September as global demand weakened. The news raises fresh questions about recent efforts to revive the slowing economy. “With this engine of growth stalling, other areas of the economy such as investment and consumption will need to step up to complete this year’s growth objectives,” notes a report from ING Economics.

Oil prices (Brent) fell sharply on Tuesday, dropping more than 4% to a near two-week low after media reports said Israel will not strike Iranian oil targets. If true, the decision will ease concerns of a supply disruption. “Weakening demand has led to traders withdrawing the ‘war premium’ from prices,” says Priyanka Sachdeva, senior market analyst at Phillip Nova.

Author: James Picerno