Macro Briefing: 16 April 2024

* Another round of Fed rate hikes is possible, advise UBS strategists * China’s economy grew faster than expected in Q1, but… * New home prices in China fall at fastest rate since 2015 * NY Fed Mfg Index continues to indicate contraction in April * US home builder sentiment steady at modest grow…

* Another round of Fed rate hikes is possible, advise UBS strategists

* China’s economy grew faster than expected in Q1, but…

* New home prices in China fall at fastest rate since 2015

* NY Fed Mfg Index continues to indicate contraction in April

* US home builder sentiment steady at modest growth level in April

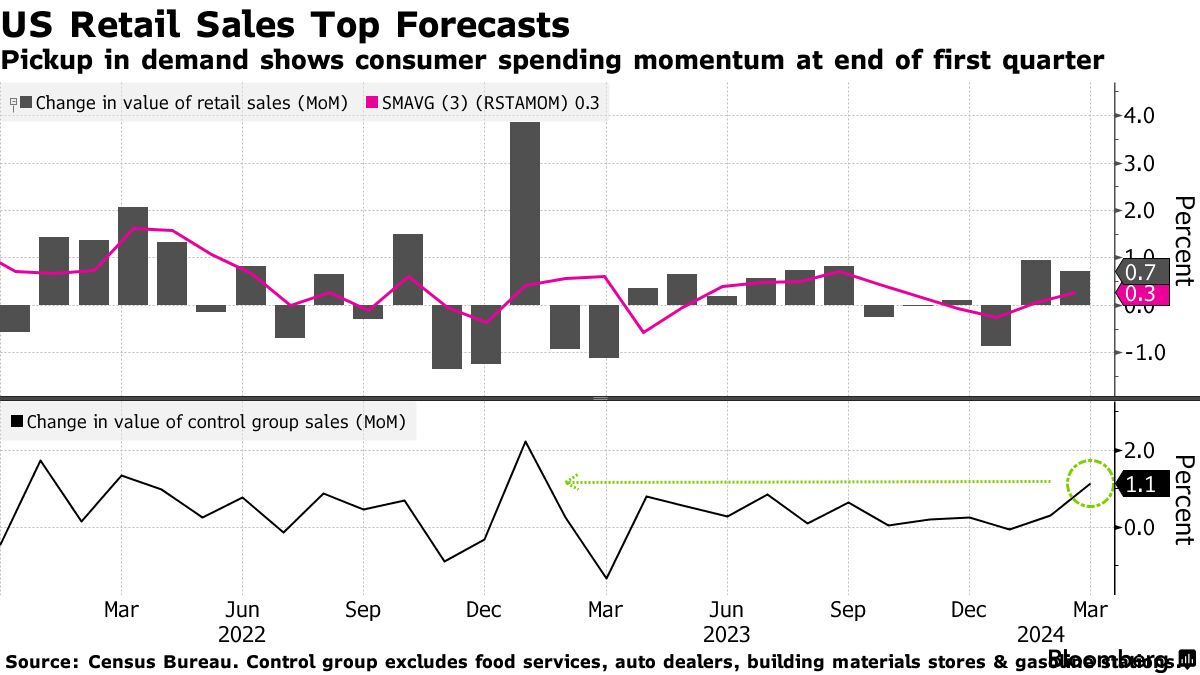

* US retail sales rose more than forecast in March:

Economists expect US economic growth will persist for near term while sticky inflation remains an issue, according to recent polls, Fortune reports. “Nearly half of all investors polled by Deutsche Bank in March said they expect a “no landing” scenario, where the economy continues to grow and unemployment stays low, but inflation remains an issue despite the Federal Reserve’s interest rate hikes.

The Wells Fargo Investment Institute piled on to that narrative in a note Monday upgrading its outlook for the U.S. economy. While the bank didn’t specifically predict a “no landing” outcome, researchers lifted their gross domestic product growth forecast from just 1.3% for 2024 to 2.5%—the same as last year’s rate of 2.5%.”

For the upcoming first-quarter GDP report, the Atlanta Fed’s current nowcast estimates output rising 2.8%, marking a slowdown from Q4.

Author: James Picerno