Macro Briefing: 16 August 2024

* US jobless claims fall for second week in sign of labor market resiliency * US homebuilder sentiment falls to eight-month low In August * US industrial output drops in July by most since the start of the year * NY Fed Mfg Index stays negative in August * US retail spending rises much more than exp…

* US jobless claims fall for second week in sign of labor market resiliency

* US homebuilder sentiment falls to eight-month low In August

* US industrial output drops in July by most since the start of the year

* NY Fed Mfg Index stays negative in August

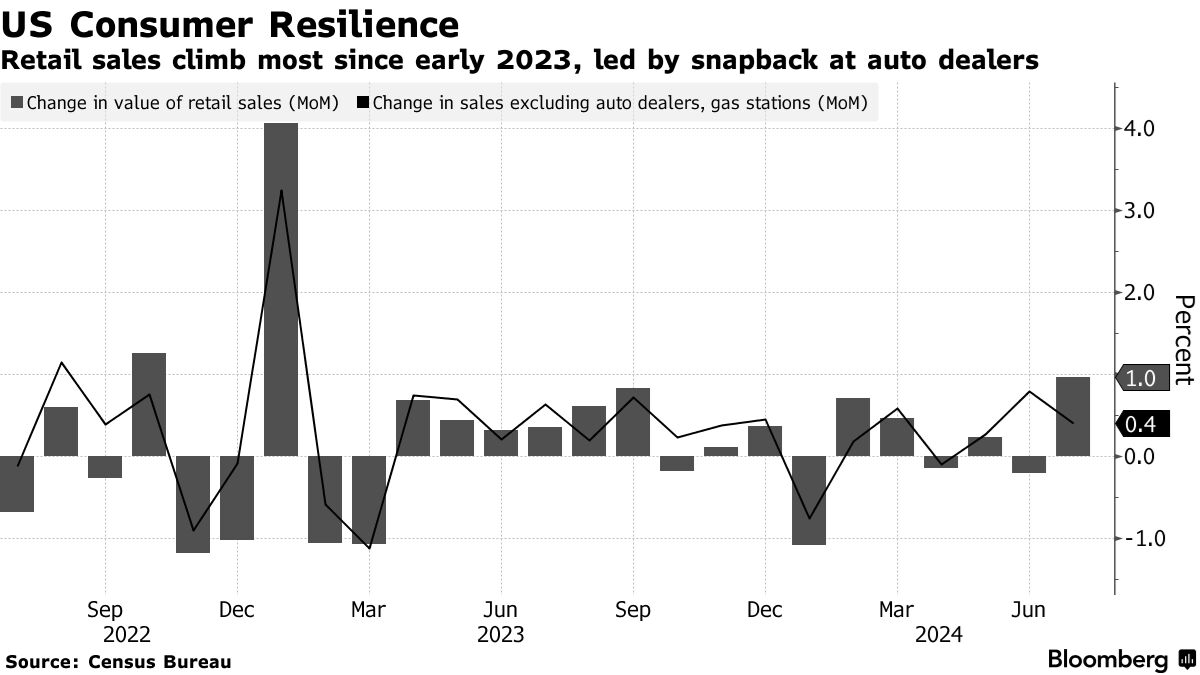

* US retail spending rises much more than expected in July:

Wednesday’s economic reports cool US recession fears. The combination of stronger-than-expected retails sales in July and another slide in weekly jobless claims bring new data points to the fore that suggest the economy is still expanding. “All of a sudden, things have come together,” BMO Wealth Management US chief investment officer Yung-Yu Ma tells Yahoo Finance. “And what seems like almost a Goldilocks scenario for the data is a tremendous shift from what we had a week or so ago when we had the market sell-off.”

Author: James Picerno