Macro Briefing: 16 September 2024

The US economy will experience a soft landing, according to forecasts from economists in new survey published by the Financial Times…” Recent data releases for China paint a gloomy outlook for its economy as analysts downgrade expectations for the country’s full year GDP growth……

A busy week of central bank decisions awaits in the days ahead, including the Federal Reserve’s expected announcement of a rate cut on Wed., Sep. 18. Central banks in Brazil, England, Norway and South Africa are also set to hold policy meetings this week. “We’re entering a cutting phase,” says John Bilton, global head of multi-asset strategy at JP Morgan Asset Management.

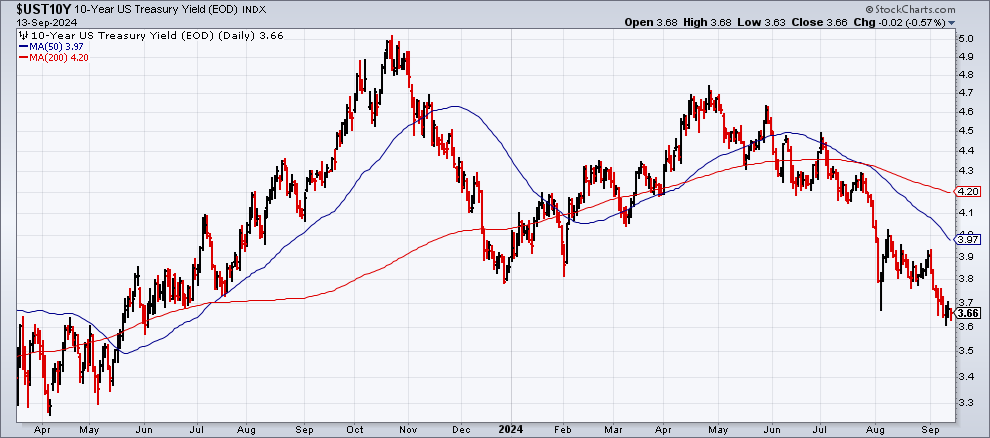

The US 10-year Treasury yield closed last week at 3.66%, near the lowest level since June 2023. The recent slide in the benchmark rate comes amid the consensus view that the Federal Reserve will cut interest rates on Wednesday (Sep. 18). Fed funds futures are estimating a coin toss between a 1/4-point vs. a 1/2-point reduction in the target rate.

The US economy will experience a soft landing, according to forecasts from economists in new survey published by the Financial Times. “GDP growth will be 2.3% in 2024 and 2% in 2025, according to the median estimates by the economists polled in the FT-Chicago Booth survey.”

Recent data releases for China paint a gloomy outlook for its economy as analysts downgrade expectations for the country’s full year GDP growth. “Both the long term issues related to property prices and so on, and the short term issues related to domestic demand in particular, especially private investment and household consumption have not been doing well at all,” says Eswar Prasad, professor of international trade and economics at Cornell University.

Gold climbed to a new record high, extending last week’s rally. “Whether the Fed cuts by 25 or 50 bps does matter in the short term,” says Ole Hansen, head of commodities strategy at Saxo Bank A/S. “A disunited world loaded up on geopolitical risks and debt will continue to underpin prices.”

Oil briefly traded at the lowest level since May 2023 last week, based on the US benchmark.

Author: James Picerno