Macro Briefing: 17 April 2025

US retail sales soared in March, posting the strongest monthly gain in over two years… “The strong rebound in retail sales in March was boosted by a surge in auto sales and a more general front-loading of consumer spending ahead of tariffs,” wrote Oxford Economics deputy chief US economist …

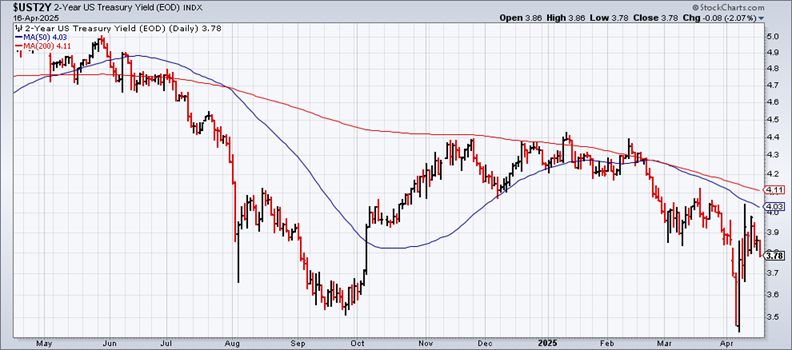

Federal Reserve Chairman Powell outlined a plan on Wednesday for a scenario of higher inflation and slower growth. “The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth,” he said at the Economic Club of Chicago. “For the time being, we are well positioned to wait for greater clarity” regarding policy changes linked to immigration, taxation, regulation, and tariffs, he noted. The policy-sensitive US 2-year Treasury yield eased yesterday, closing near the low of recent months and signaling that the market is still expecting rate cuts at some point in the near term.

US retail sales soared in March, posting the strongest monthly gain in over two years. “The strong rebound in retail sales in March was boosted by a surge in auto sales and a more general front-loading of consumer spending ahead of tariffs,” wrote Oxford Economics deputy chief US economist Michael Pearce in a note.

US industrial output fell in March, but the manufacturing component increased. “The decline is really driven by utilities, just due to a warmer period of weather,” said analyst Jonathan Sakraida at CFRA Research. But the manufacturing strength may be temporary because of tariffs. “We’re seeing this really being driven by tariff-led pre-buying activity — manufacturers trying to get ahead of any kind of punitive levies.”

US homebuilder sentiment remains depressed in April. “Builders have expressed growing uncertainty over market conditions as tariffs have increased price volatility for building materials at a time when the industry continues to grapple with labor shortages and a lack of buildable lots,” said the NAHB chairman.

The Federal Reserve remains in a “wait and see” mode, relying on preemptive policy cuts from last fall to minimize inflation. Fed Governor Waller expects that any tariff-related inflation will be temporary. TMC Research’s Fed funds model shows a widening spread between the current median Fed funds target rate and the falling estimate of a neutral rate – a sign that Fed policy may be passively shifting to a more restrictive phase lately, albeit on the margins so far.

Author: James Picerno