Macro Briefing: 17 December 2024

US economic activity accelerated to a 33-month high in December, according to the US Composite, a survey-based GDP proxy… “The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just o…

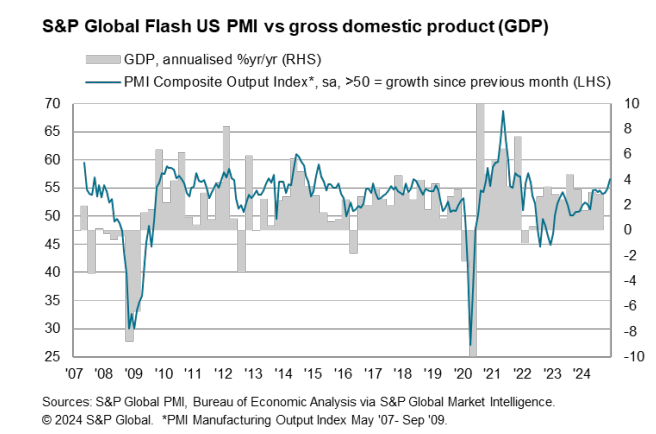

US economic activity accelerated to a 33-month high in December, according to the US Composite, a survey-based GDP proxy. “Business is booming in the US services economy, where output is growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. “The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just over 3% in December.”

Despite ongoing inflation pressures, the Federal Reserve is expected to cut interest rates this week. Fed funds futures are pricing in 97% probability for a cut in Wednesday’s policy announcement.

NY Fed Manufacturing Index pulls back more than expected in December. Following a sharp rebound in November, the index fell to a slightly positive reading for this month.

Japanese tech billionaire Masayoshi Son pledges pledges a major US investment. Appearing with president-elect Trump at a press conference on Monday, Son said he would invest $100bn over four years and create 100,000 jobs.

Eurozone business activity continues to decline as “employment falls at fastest pace in four years,” based on the December update of the PMI survey data. “The end of the year is somewhat more conciliatory than was generally expected,” says Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “Service sector activity returned to growth territory and is showing a noticeable, if not exuberant, pace of expansion, similar to that seen in September and October. While manufacturing is still deep in recession, the rebound in services output is a welcome boost for the overall economy.”

Author: James Picerno