Macro Briefing: 17 February 2025

US retail sales fell more than expected in January…A rise in US business optimism has been accompanied recently by higher uncertainty triggered by tariffs and other policy changes… “You’ve really got a battle between greater business optimism and greater business uncertainty, and they’r…

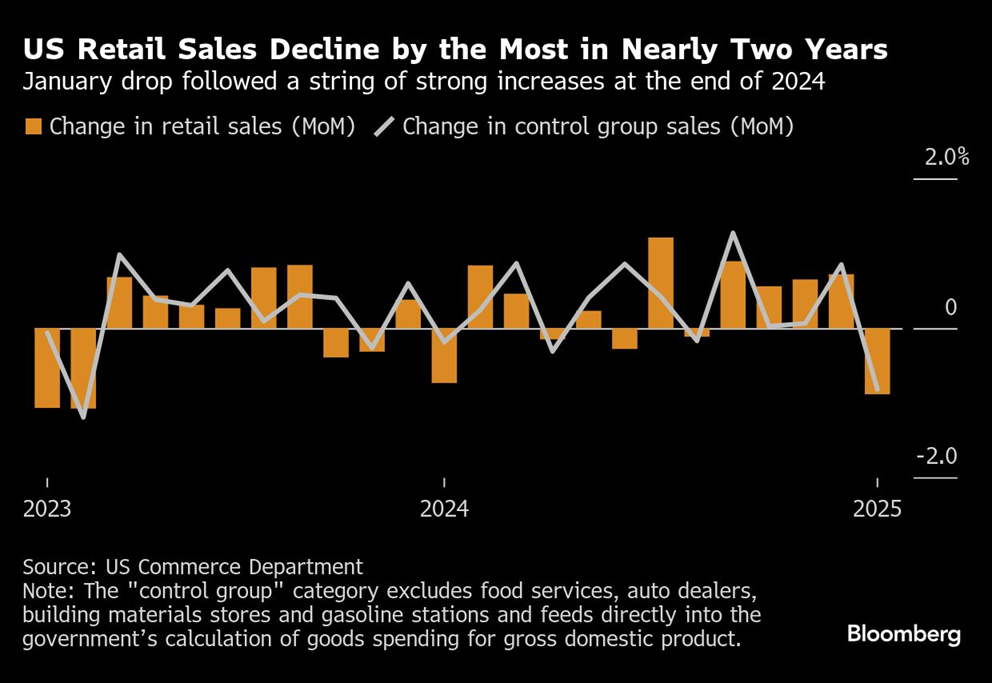

US retail sales fell more than expected in January. The sharp 0.9% drop last month was partly due to cold weather that suppressed sales of new cars. The average temperature in January was the lowest since 1988, Pantheon Macroeconomics advises. The fires in Los Angeles were also a temporary factor driving sales down.

A rise in US business optimism has been accompanied recently by higher uncertainty triggered by tariffs and other policy changes. “You’ve really got a battle between greater business optimism and greater business uncertainty, and they’re kind of opposing forces,” says Nicholas Bloom, a Stanford University professor who studies the interaction of uncertainty and the economy.

US industrial output rose more than expected in January. The bigger than expected increase by industrial production was driven by a sharp rise utilities output due to cold temperatures that boosted heating demand.

Gold has become the best performing “Trump trade” in recent weeks, Financial Times reports. “When trade contracts, gold takes off,” says James Steel, precious metals analyst at HSBC. He notes similar examples during the Covid pandemic and the global financial crisis. “The more tariffs that go on, the more this is going to disrupt world trade, and the better it will be for gold.”

Lofty valuation metrics for the US stock market have, so far, been largely ignored by investors. “The persistent rise in US equities is helping promote a view that the relationships of old for stocks and traditional measures for value-oriented investing strategies no longer apply,” observes a note from TMC Research, a unit of The Milwaukee Company, a wealth manager. “But after more than two years of a mostly steady rise in US stocks, investors with longer-term time horizons are cautiously eyeing market valuations that, by historical standards, look unusually high… Professor Robert Shiller’s CAPE Ratio (cyclically adjusted price-to-earnings ratio) is currently tied with mid-2021 for posting the second-highest valuation level in more than a century – a level that implies substantially lower returns for stocks in the medium-to-long-run future vs. recent history. A variation on the CAPE Ratio that adjusts the metric using real (inflation-adjusted) yields for an arguably superior modeling exercise implies that investors should dramatically reduce expectations for S&P 500 returns for the years ahead.”

Author: James Picerno