Macro Briefing: 17 October 2025

A rolling 3-month window for daily returns between bitcoin and stocks has been trending higher lately, indicaticating a higher level of alignment…US stocks fell on Thursday amid growing concerns about regional bank loans… An ETF targeting regional bank stocks (KRE) dropped 6…” Bitcoin’s c…

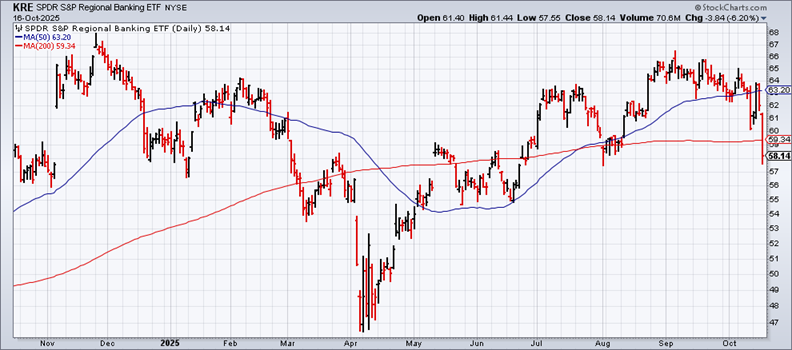

US stocks fell on Thursday amid growing concerns about regional bank loans. “Credit quality worries are plaguing Wall Street today as fears mount that there are multiple large lenders with heavy exposure to problematic loans with limited collateral,” said José Torres, senior economist at Interactive Brokers. An ETF targeting regional bank stocks (KRE) dropped 6.2% yesterday, closing at the lowest level since August.

Gold rose to another record high on Thursday, driven by a range of worries, including by new concerns about credit quality in the economy. “With rate-cut expectations, geopolitical risks, and lingering banking concerns all in play, the environment remains highly supportive for gold,” said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany. “Short-term consolidation is possible given the overbought conditions.”

The US 10-year Treasury yield fell below 4% on Thursday. The decline to 3.97% marks the lowest level for the benchmark rate since April.

A top Federal Reserve official backed additional rate cuts on Thursday. Christopher Waller, a leading candidate to replace Jay Powell as Fed chair next year, also expressed caution for the policy path: “Since we don’t know which way the data will break on this conflict, we need to move with care when adjusting the policy rate to ensure we don’t make a mistake that will be costly to correct.”

Bitcoin’s correlation with US stocks (S&P 500) has been rising recently, raising questions about the cryptocurrency’s value as a diversification tool for portfolio strategies, advises TMC Research, a unit of The Milwaukee Company. A rolling 3-month window for daily returns between bitcoin and stocks has been trending higher lately, indicaticating a higher level of alignment.

Author: James Picerno