Macro Briefing: 17 September 2024

New York Fed Manufacturing Index indicates a strong rebound in business activity for September… “Inflation is now back down close to pre-pandemic levels, and that means the focus needs to be on safeguarding the gains — the important gains — we’ve made in the labor market,” observes Whit…

US economy is at an “important turning point,” says the top economic advisor in the White House. “Inflation is now back down close to pre-pandemic levels, and that means the focus needs to be on safeguarding the gains — the important gains — we’ve made in the labor market,” observes White House National Economic Advisor Lael Brainard.

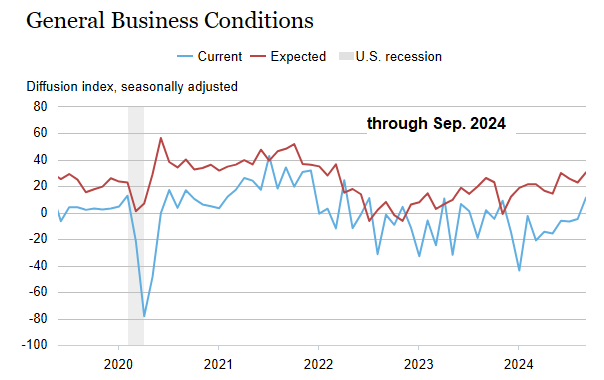

New York Fed Manufacturing Index indicates a strong rebound in business activity for September. “Business activity grew in New York State for the first time in nearly a year, according to firms responding to the September 2024 Empire State Manufacturing Survey,” the bank reports. “New orders climbed, and shipments grew significantly.”

The recent increase in US household wealth may boost odds for a soft economic landing. The Federal Reserve last week reported that higher home prices and the stock market raised households’ net worth by $2.8 trillion to a record $163.8 trillion in the second quarter. Household net worth soared by nearly $47.0 trillion from the pre-pandemic peak less than five years ago. “While it is popular to focus on the demise of American society and the US economy, the reality is that American households have never been wealthier, and the level and growth of net worth still far surpasses any other economy globally,” Lazard’s chief market strategist, Ronald Temple, wrote in a research note last week.

Despite soaring Federal debt, neither presidential candidate is talking about the topic. Without action from Congress, total debt is set to rise $22 trillion through 2034, closing in on 125% of gross domestic product, higher than the peak in World War II. The Wall Street Journal reports: “The country’s fiscal trajectory merits only sporadic mentions by the major-party presidential nominees, let alone a serious plan to address it. Instead, the candidates are tripping over each other to make expensive promises to voters.”

TMC Research’s Fed funds model has been indicating for several months that a larger-than-expected rate cut is reasonable if not likely. Market expectations via Fed funds futures are now embracing the idea, based on changing estimates in recent days.

Author: James Picerno