Macro Briefing: 18 December 2024

US retail sales rose for a third straight month in November… “We ultimately expect this will be a decent holiday sales season for retailers,” writes Tim Quinlan, an economist at Wells Fargo, in a note to clients…7% last month, beating expectations… The Federal Reserve is expected to cuts i…

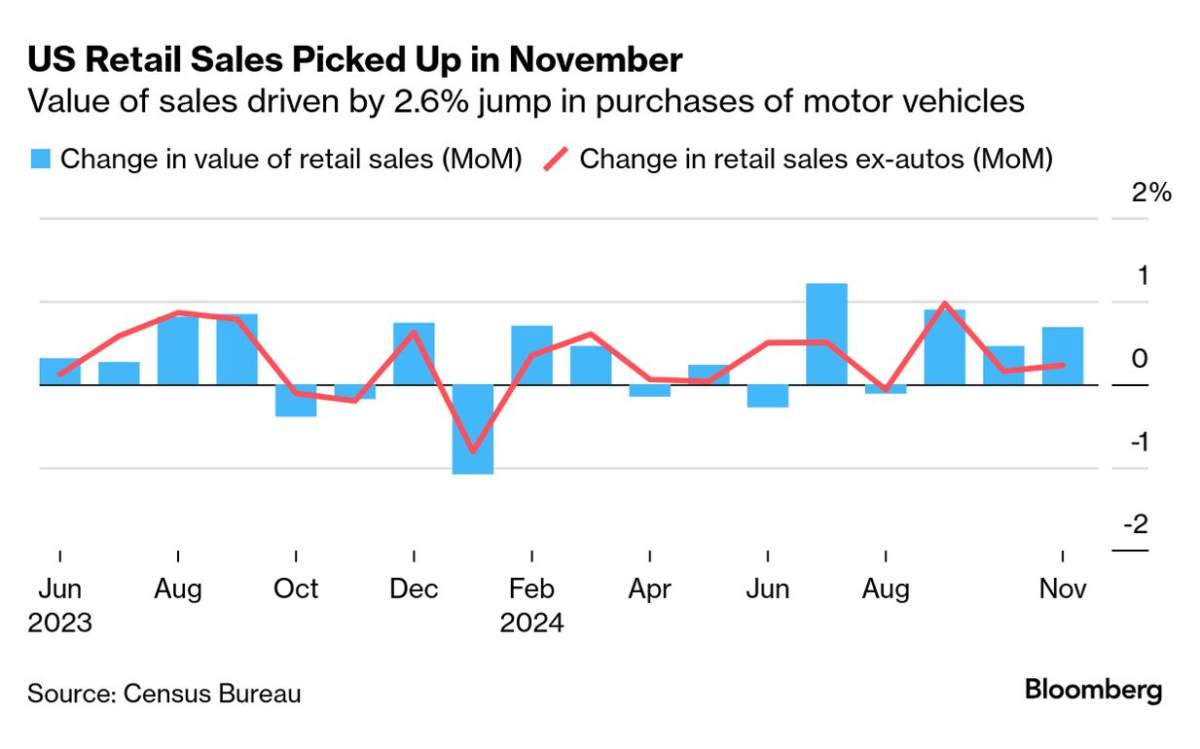

US retail sales rose for a third straight month in November. Spending rose 0.7% last month, beating expectations. “We ultimately expect this will be a decent holiday sales season for retailers,” writes Tim Quinlan, an economist at Wells Fargo, in a note to clients. “It’s not going to knock anyone’s socks off in the wake of record pandemic gains, but continued consumer momentum means it’s unlikely to be overly weak either.”

US industrial production posts surprising decline in November due to weaker utility output and mining. The 0.1% slide in production at factories, mines and utilities followed a downwardly revised 0.4% drop a month earlier, according to Federal Reserve data. The decline marks the third straight monthly loss.

US home builder confidence held steady in December. The unchanged reading is the highest since April. While builders are expressing concerns that high interest rates, elevated construction costs and a lack of buildable lots continue to act as headwinds, they are also anticipating future regulatory relief in the aftermath of the election,” says NAHB Chairman Carl Harris.

The Federal Reserve is expected to cuts interest rates today, despite recent reports of sticky inflation. An announcement is due at 2pm eastern. “I’d be inclined to say ‘no cut,’” says former Kansas City Fed President Esther George. “Let’s wait and see how the data comes in. Twenty-five basis points usually doesn’t make or break where we are, but I do think it is a time to signal to markets and to the public that they have not taken their eye off the ball of inflation.”

The policy-sensitive US 2-year Treasury yield rose for a seventh straight day on Tuesday, ahead of today’s Fed announcement on interest rates. The 2-year yield edged up to 4.27%, a 3-week high:

Author: James Picerno