Macro Briefing: 19 December 2025

US consumer inflation’s annual pace slowed more than expected in November, the Labor Department’s Bureau of Labor Statistics said… “The report wasn’t just noisy and full of gaps, it provided a downwardly biased perspective of inflation,” said Gregory Daco, chief economist at EY-Parthenon…

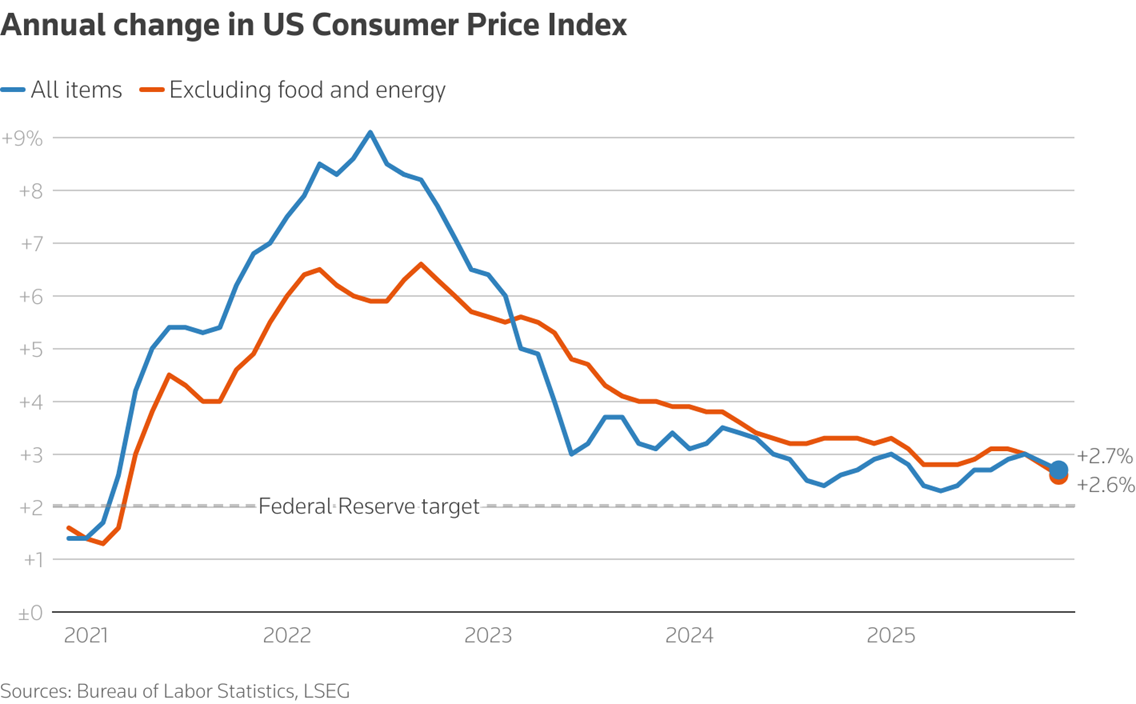

US consumer inflation’s annual pace slowed more than expected in November, the Labor Department’s Bureau of Labor Statistics said. Headline CPI dipped to a 2.7% increase vs. the year-ago level while core CPI fell to 2.6%, a four-year low. Some analysts raised doubts about the numbers, citing the disruption in data collection due to the government shutdown. “The report wasn’t just noisy and full of gaps, it provided a downwardly biased perspective of inflation,” said Gregory Daco, chief economist at EY-Parthenon. “The downward bias stemmed from the carry-forward methodology that assumed an unchanged price index in October for all surveyed data – imparting a downward bias to inflation dynamics.”

US jobless claims fell last week, indicating that layoffs remain low, printing at a middling level vs. the range over the past year. Filings for new unemployment benefits dropped 13,000 to 224,000 for the week ending Dec. 13.

The US Leading Economic Index fell 0.3% in September, the Conference Board reports. The LEI fell by 2.1% over the six months between March and September 2025, a faster rate of decline than its 1.3% contraction over the previous six-month period (September 2024 to March 2025), and signaling weaker economic conditions ahead.

The Bank of Japan raised its short-term interest rate to a 30-year high. The central bank said rates are expected to remain “significantly negative,” adding that accommodative financial conditions will continue to firmly support economic activity.

The US 10-year Treasury yield fell after the government reported the consumer inflation cooled in November. The benchmark rate dropped to 4.12% on Thursday, the lowest close in nearly two weeks:

Author: James Picerno