Macro Briefing: 19 February 2025

The rise was fueled in part by a strong increase by the new orders index… The analysis is based on an indicator that tracks the 10-year rate in terms of its current percentage of its maximum level over the trailing 200-trading-day window… The index has been been below 50 since May and reflects …

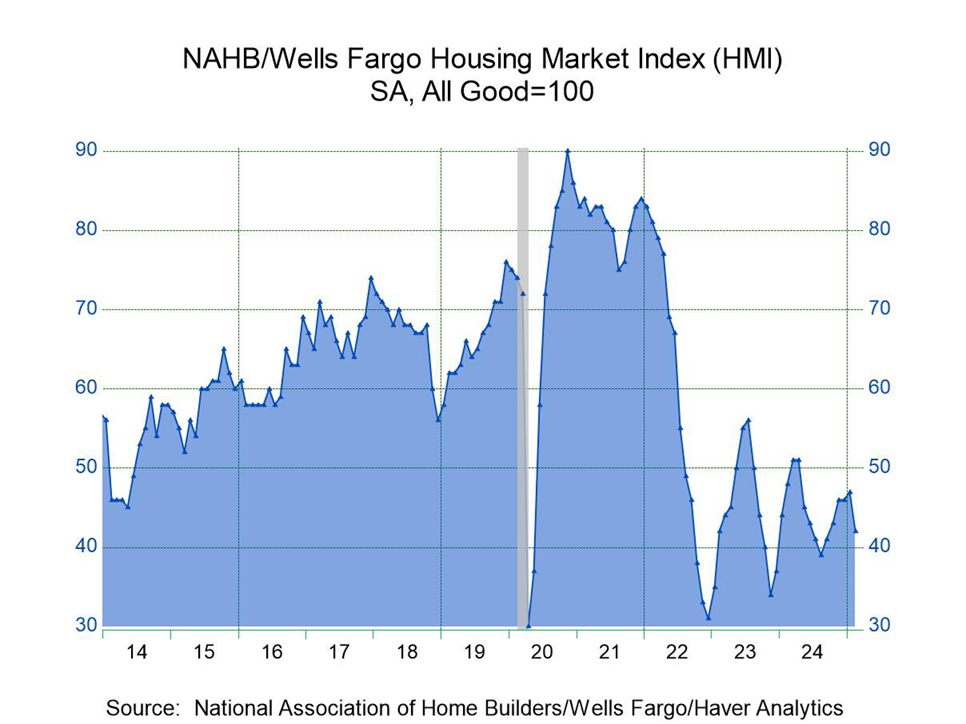

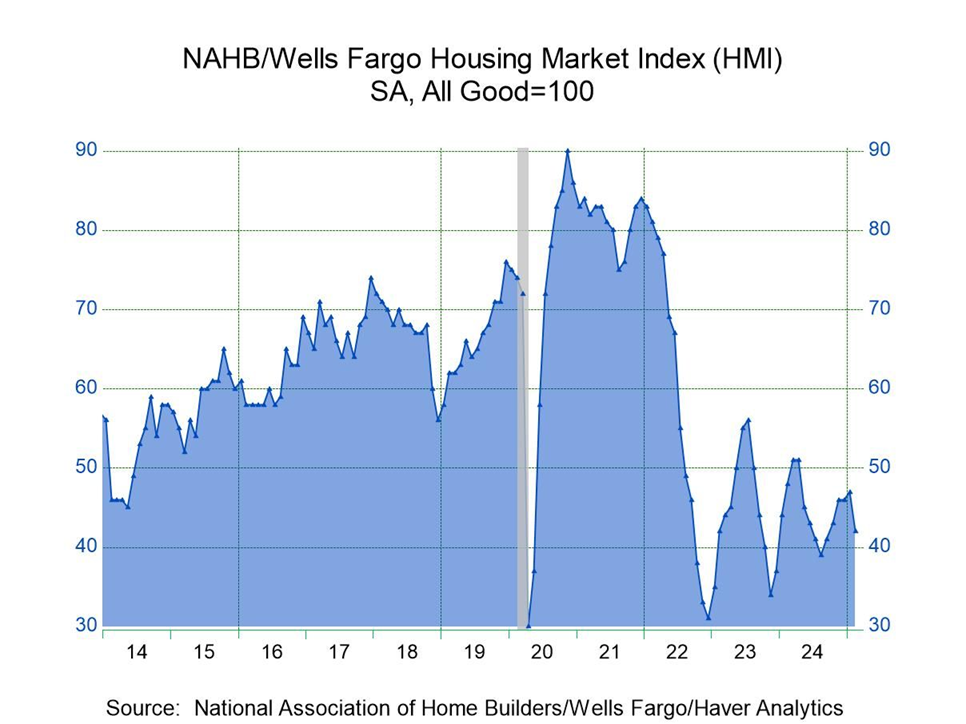

The US Housing Market Index, a survey-based measure of home builder sentiment, fell further below the neutral 50 mark in February. The index has been been below 50 since May and reflects a cautious outlook among US home builders for the near-term outlook.

NY Fed Manufacturing Index rebounds more than expected in February, marking a return to modest growth after slumping in the previous month. The rise was fueled in part by a strong increase by the new orders index.

US and Russia “begin working on a path” to end Ukraine war as Trump blames Ukraine for starting the war. Axios notes: “Trump’s comments — falsely suggesting Ukraine started the war and that Zelensky is deeply unpopular with his own people — will supercharge fears among Ukraine and U.S. allies that the Trump administration is siding with Moscow ahead of possible peace talks.”

Trump says he plans to impose tariffs of around 25% on auto imports as well as semiconductors and pharmaceuticals shipped to the United States as early as April 2. For tariffs on semiconductor chips and drugs, he says the tariffs will eventually rise further.

US overtook China to become Germany’s single-biggest trading partner in 2024. Trade between the US and Germany, Europe’s biggest economy, rose 0.1% last year over 2023’s level, Germany’s Federal Statistical Office reports.

The recent rise of the US 10-Year Treasury yield remains a risk factor for stocks, advises a note from TMC Research, a unit of The Milwaukee Company, a wealth manager. The analysis is based on an indicator that tracks the 10-year rate in terms of its current percentage of its maximum level over the trailing 200-trading-day window. The current 95% reading continues to signal elevated risk for stocks (S&P 500 Index).

Author: James Picerno