Macro Briefing: 19 March 2024

Citing a growing economy and sticky inflation, he tells CNBC: “I’m in the camp that the Fed does not change policy in the summer of an election year…” The government bond market increasingly agrees, based on the policy-sensitive 2-year Treasury yield, which rose to its highest level since D…

* Japan’s central bank lifts interest rates for first time since 2007

* Federal court temporarily halts SEC’s new climate-disclosure rules

* Nvidia announces new generation of artificial intelligence chips

* Google and Apple reportedly discussing use of Gemini’s generative AI in iPhones

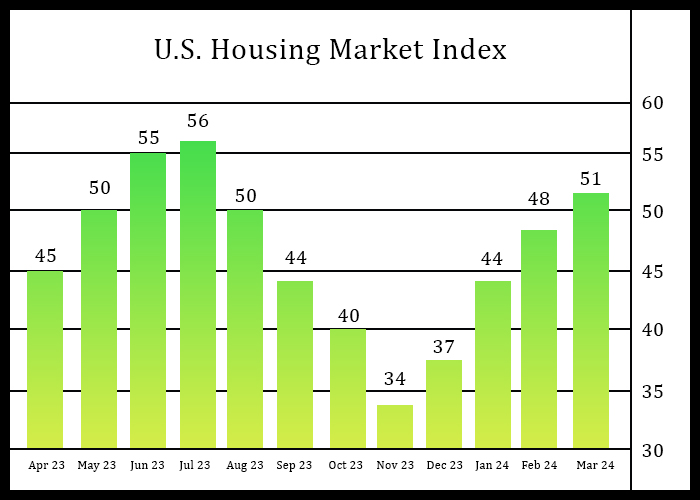

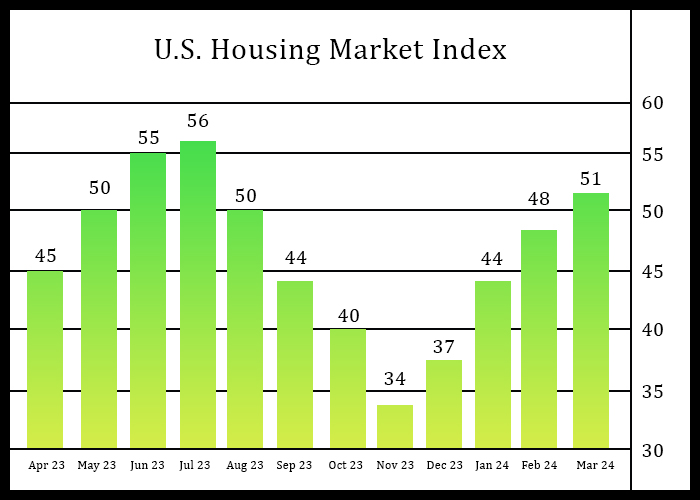

* US homebuilder sentiment rises to 8-month high in March:

The central bank will likely leave rates unchanged until next year, predicts Jim Bianco, president of Bianco Research. Citing a growing economy and sticky inflation, he tells CNBC: “I’m in the camp that the Fed does not change policy in the summer of an election year. If they don’t pull the trigger by June, then it’s November [or] December at the earliest — only if the data warrants it. And, right now, the data isn’t warranting it.” The government bond market increasingly agrees, based on the policy-sensitive 2-year Treasury yield, which rose to its highest level since December on Monday (Mar. 18).

Author: James Picerno