Macro Briefing: 19 September 2024

US government shutdown risk rises as House rejects temporary fund bill… The government needs a stopgap measure to prevent a partial shutdown when new budget year begins Oct… “We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemploy…

US government shutdown risk rises as House rejects temporary fund bill. The government needs a stopgap measure to prevent a partial shutdown when new budget year begins Oct. 1.

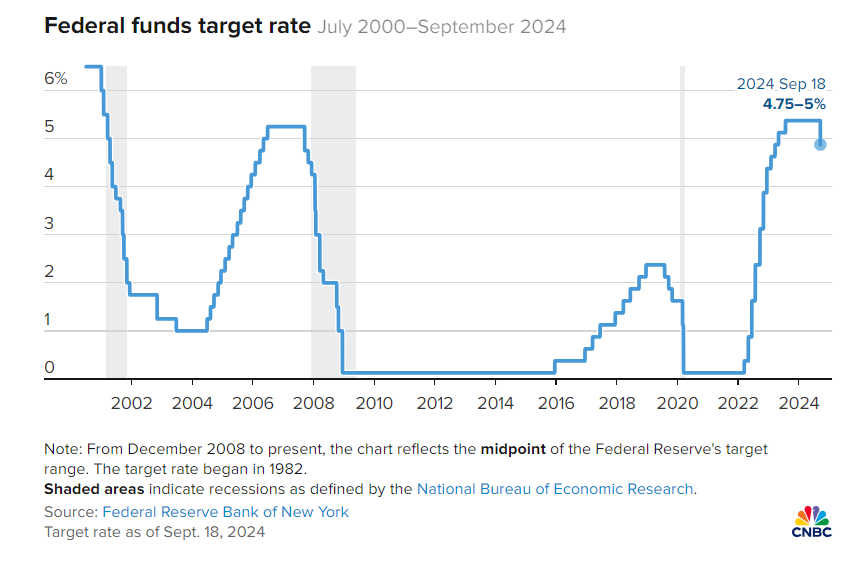

The Federal Reserve cut interest rates, reducing its target rate by 1/2-percentage point to a 4.75%-to-5.25% range. “We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation,” says Fed Chairman Powell.

New Federal Reserve economic forecasts for US GDP tick down to +2.0% for 2024 and hold steady at +2.0% for 2025 compared with the June estimates. Revised estimates for core inflation edge down to 2.6% for this year and 2.2% for 2025.

Fed officials expect that the central bank will deploy a softer pace of rate cuts in future meetings, based on the so-called dot-plot that summarizes policymakers’ outlook. Morningstar reports that the estimates imply two “25 basis points [cuts] in the final two meetings of 2024. Additionally, Fed projections call for a year-end 2025 federal-funds rate of 3.25%-3.50%.”

Author: James Picerno