Macro Briefing: 2 August 2024

* US jobless claims rise to one-high year * Wage growth in US for Q2 eased to slowest pace in 3-1/2 years * US light-vehicle sales rebounded modestly in July * Construction spending in the US fell for second month in June * ISM Mfg Index dips in July, signaling ongoing sector contraction:The US 1…

* US jobless claims rise to one-high year

* Wage growth in US for Q2 eased to slowest pace in 3-1/2 years

* US light-vehicle sales rebounded modestly in July

* Construction spending in the US fell for second month in June

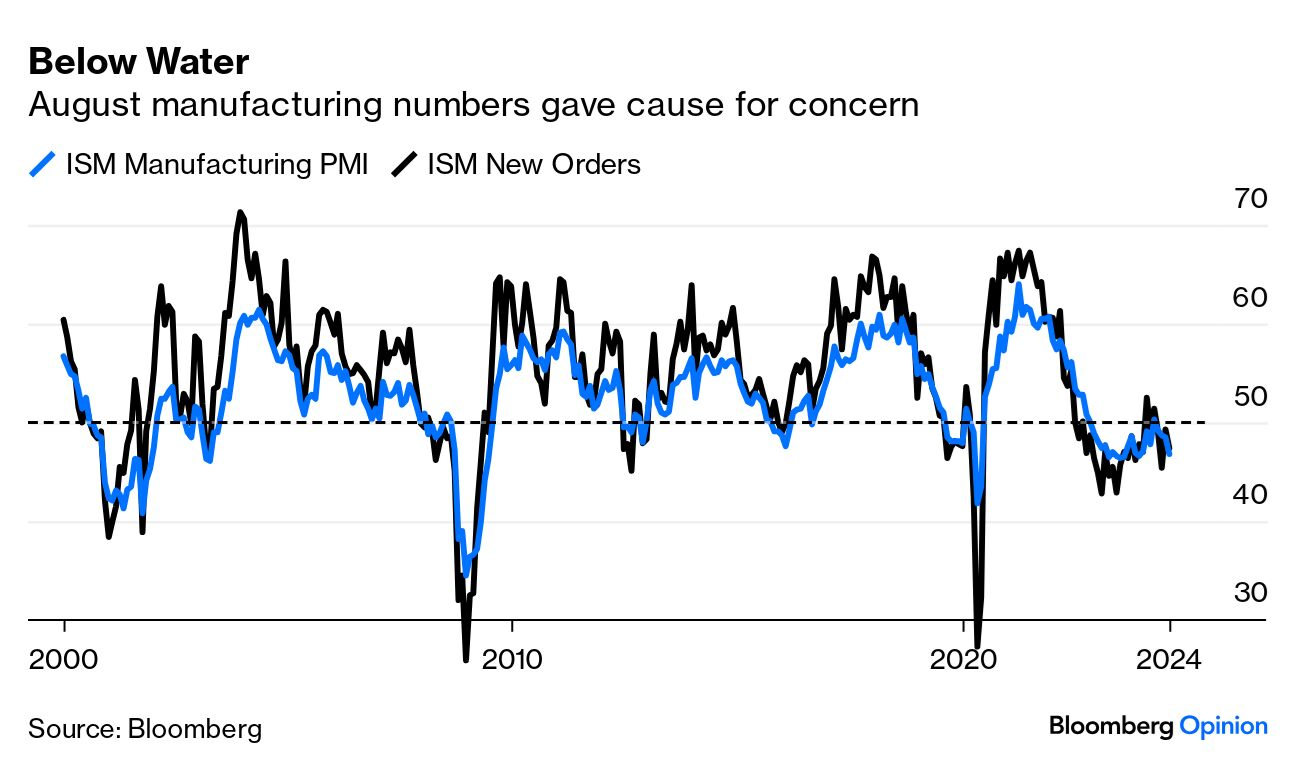

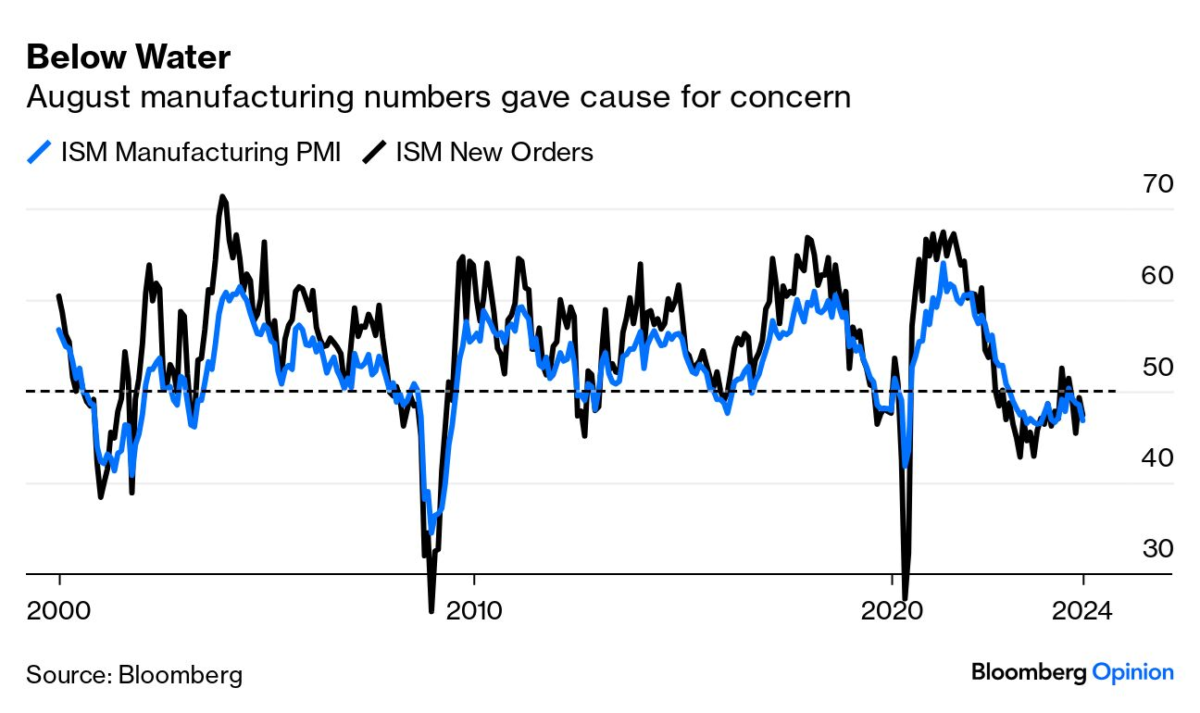

* ISM Mfg Index dips in July, signaling ongoing sector contraction:

The US 10-year Treasury yield fell below 4.0% for the first time since Feb. 1 on Thursday (Aug. 1). The Wall Street Journal reports: “U.S. 10-year Treasury yield may fall further, based on the weekly chart, says Quek Ser Leang, markets strategist at UOB Global Economics & Markets Research. During the week, the yield dropped clearly below the bottom of the weekly Ichimoku cloud and the psychological 4.00% level, the strategist notes in a research report. Although the week isn’t over yet, the break of the key weekly support indicates a potential for the yield to continue falling in coming weeks and months, the strategist says.”

Author: James Picerno