Macro Briefing: 2 July 2024

5% in June * US construction spending posts unexpected decline in May * US manufacturing sector contracts for third straight month via ISM survey:Expectations that the Federal Reserve will start cutting interest rates later this year could be a sign that the US dollar’s rally in 2024 has peaked…

* Signs of cooling US labor market put Fed on alert

* Global manufacturing PMI indicates weak growth continued in June

* Eurozone headline inflation eases to 2.5% in June

* US construction spending posts unexpected decline in May

* US manufacturing sector contracts for third straight month via ISM survey:

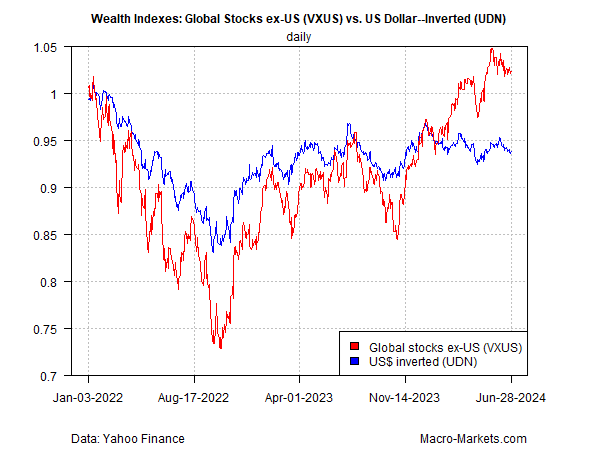

Expectations that the Federal Reserve will start cutting interest rates later this year could be a sign that the US dollar’s rally in 2024 has peaked. If so, a softer currency would be a new tailwind for foreign equities, advises a new research note from TMC Research, a division of The Milwaukee Company, a wealth management firm. “All else equal, a stronger dollar translates into fewer dollar-based earnings after translating foreign currencies into greenbacks. The opposite is also true, and so a weaker dollar boosts offshore earnings from a US perspective,” the report notes. “Markets tend to price in this relationship, which means that the dollar’s trend is a key factor that determines the strength of headwinds and tailwinds for global shares outside the US.”

Author: James Picerno